Summary

The travel credit on the Chase Sapphire Reserve is one of the most flexible available on a luxury card, especially if you know how to take advantage of it.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Luxury cards come packed with travel credits and perks that help offset their high annual fees, and one of the most lauded among them is the flexible travel credit on the Chase Sapphire Reserve®. For starters, Reserve cardholders get a whopping $300 in statement credits every year that can be used for any travel purchase.

It is easy to see the value in such a huge number, but you can get even more out of it by understanding how it works and following a few key strategies.

Chase Sapphire Reserve: At a glance

| Chase Sapphire Reserve | |

Why get this card? Thanks to its generous $300 annual travel credit that covers nearly any travel expense, including airfare, the Chase Sapphire Reserve card is an exceptionally valuable travel card that makes luxury travel benefits accessible for travelers on a wide range of budgets. | Other things to know:

|

What purchases qualify for the travel credit?

The Chase Sapphire Reserve card’s travel credit is one of the most flexible offered by a rewards card – encompassing all kinds of travel purchases. Not only will traditional transactions like airfare qualify for a statement credit, but purchases such as parking garage tickets are also eligible. Here’s a quick look at a few qualifying purchases:

- Flights

- Hotel stays

- Parking garages

- Toll booths

- Pedicab rides

- Taxi rides (including ride-share services)

- Public transportation

This is just a sampling of purchases that are eligible. To determine exactly what you can buy and use your travel credit for, you’ll need to see how charges code on your credit card statement.

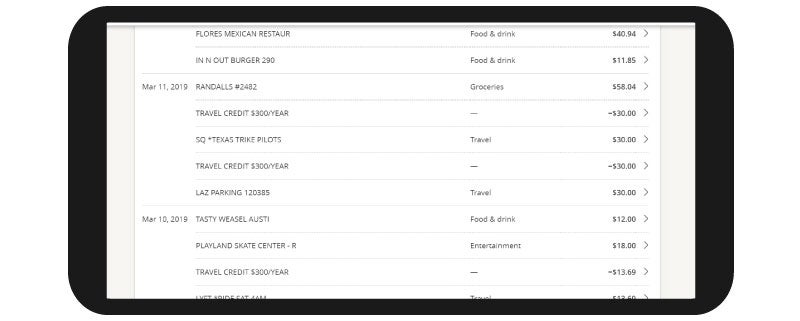

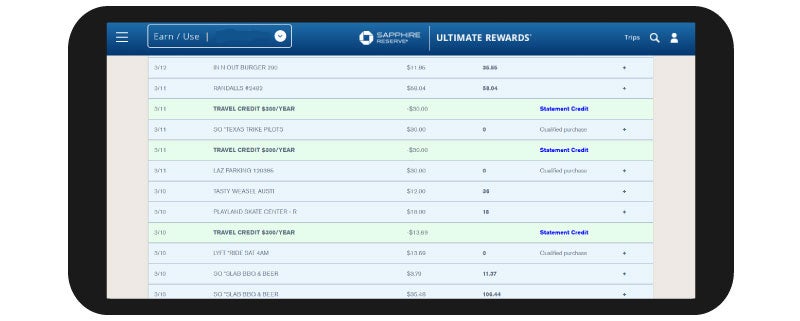

To help Chase identify which purchases should receive bonus points or count toward travel credits like this one, retailers are assigned a merchant category code. Depending on this code, the bank can then identify which purchases are food, which are travel and so on. If you aren’t sure if a purchase will code as travel using this system, you can always make a small sample purchase and see how it displays on your credit card statement. Here’s how it looks for Sapphire Reserve cardholders.

You can also use this feature to visualize which purchases qualify for bonus points on dining purchases.

Travel credit extension amid coronavirus

To accommodate for changes in spending patterns during the coronavirus pandemic, Chase recently announced that it would be extending the Sapphire Reserve travel credit for a limited time. Through Dec. 31, 2021, the credit will cover gas and grocery store purchases, in addition to the travel purchases mentioned above.

For those who are still cautious about travel in the current environment, this promotion is sure to add a lot of value back to the card.

How do I receive my travel credit?

Luckily, taking advantage of the Chase Sapphire Reserve travel credit is as easy as using your card. When you make a travel purchase on your Reserve card, Chase automatically applies a statement credit in that amount – until you reach the full $300. You can keep track of these credits through the Ultimate Rewards portal.

You can also see how much of your $300 travel credit you have already used when you log into your account, making it easy to know when you start earning 3 points per dollar on travel purchases (since this bonus kicks in only after you’ve used the credit).

![]()

Tips for maximizing the Chase Sapphire Reserve travel credit

Once you understand how the travel credit on the Chase Sapphire Reserve card works, you can take advantage of a few tips to ensure you get the full value out of the benefit.

- Make all travel purchases – including nontraditional ones like toll booths – with your Chase Sapphire Reserve card.

- Use as much of the $300 credit as possible at the beginning of the year. You won’t start earning 3 points per dollar on travel purchases until it is used up.

- Keep a close eye on the credit tracker to see how much has been redeemed. Since so many purchases code as travel, you might have used more of the $300 than you think.

- Learn how to find a business’s merchant category code to get a better idea of what purchases will count toward your travel credit.

Final thoughts

The Chase Sapphire Reserve is an incredibly rewarding travel card, thanks to a generous travel credit. By knowing what purchases count as travel and using your credit strategically every year, you can ensure you are getting great value out of your card.

Plus, the recent limited-time offer covering more kinds of purchases ensures the credit can still give value even if you don’t plan to travel in 2022. The Sapphire Reserve carries an annual fee of $550, making it important to eke as much value from the card’s benefits as possible. The offer ensures that even more conservative travelers can still get plenty of value from the Sapphire Reserve.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.