Summary

A higher credit line can translate into more spending flexibility and improved credit scores.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

When used responsibly, an increased credit limit can have a positive effect on your financial life by improving your credit, offering more spending power and allowing you to earn more cash back or points and miles.

If you have a credit card from Discover, it’s easy to request a higher credit line by contacting the issuer. However, before you reach out to Discover, be sure your credit is ready for a limit increase and know how your credit score can be affected by it.

Read on to learn how you can get a credit limit increase with Discover and what you should keep in mind when contacting the issuer.

Requesting a higher credit limit with Discover: Things to know

Eligibility requirements

Like many issuers, Discover doesn’t have a publicly available list of eligibility requirements. According to Discover, “credit limit increase criteria is taken on a case-by-case basis.” However, there’s general advice you can follow to make sure you’ll qualify for an increase.

- Pay your credit card bills on time. Your payment history is the most important credit scoring factor. If your issuer sees you’re struggling with payments, it likely won’t extend you more credit.

- Use your card regularly. If you rarely use the credit that you have, your issuer might not see the point of offering you more.

- Wait for at least six months since the account opening or the last time you requested a credit limit increase. Applying for more credit too often may be a red flag for your issuer, signaling you have trouble with debt.

Before you request a credit limit increase

Requesting a credit limit increase with Discover is easy, but there are a few things you should do before you contact the issuer.

Start by checking your credit. It’s useful to be aware of your credit’s strong and weak points as this can give you an understanding of how likely you’ll be approved and what you can use to your advantage.

For example, if you’ve recently had late payments, it’s possible that your request will be denied. However, if your credit score has improved in the last few months, it can help you secure a higher credit line.

Next, think about why you’re requesting more credit since the issuer’s representative can also ask you this question. Maybe your income has increased and you can afford to spend more, or you’re interested in a balance transfer. Maybe you’re planning a big purchase that you’d like to put on your credit card. Whatever it is, it’s crucial not to use a higher credit line as a way to accumulate more debt you can’t afford to pay.

Finally, know how much of an increase you’re going to ask for. It’s generally recommended to ask for 10% to 20% more credit. Requesting more than that may signal to Discover you’re in urgent need of funds due to financial difficulties.

Process for requesting a credit limit increase

There are a few ways you can get an increased credit limit with Discover.

Automatic credit limit increases

Discover can increase your credit automatically if you’ve been handling your account responsibly. And this requires no action from you. Discover regularly reviews cardholders’ credit card activity and may reward regular usage and a history of timely payments.

Requesting a higher credit limit online

Alternatively, you can request a credit limit increase online in your Discover credit card account. It’s a simple process that only takes a few steps.

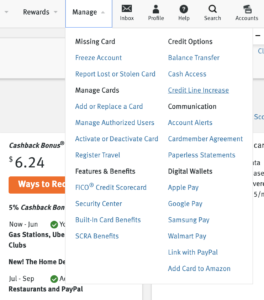

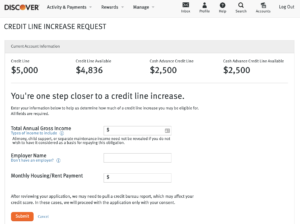

First, log in to your account. Click “Manage” in the top menu and choose “Credit Line Increase” under “Credit Options.”

Next, provide the required information and click “Submit.”

Calling customer service

Finally, you can call Discover and speak with a representative. While it may seem like going the extra mile when you can easily complete the process online, it provides an opportunity for you to negotiate your credit limit.

This is the time for you to highlight your strong points like an improved credit score, higher income and spotless payment history, as well as explain why you’re seeking more credit. While it’s not guaranteed, this might improve your approval chances, as well as result in a higher credit line than you’d get online.

Note that for the majority of applicants, the credit line increase request will not trigger a hard inquiry, meaning it won’t have any negative impact on your credit score. However, that’s not always the case.

“There are instances in which we will ask cardmembers’ permission to pull their credit in order to evaluate the line increase request application,” Discover said, explaining its policy.

Automatic increases, on the other hand, never trigger a hard pull.

What to do if your request is denied

While the process of requesting a credit limit increase with Discover is simple, there’s no guarantee your request will be granted.

If it’s denied, ask the issuer’s representative what you can do to improve your odds in the future.

Here are some tips that can help you score more credit next time:

- Build your credit. In the world of credit, good things come to those with good credit scores and positive credit histories – including credit limit increases.

- Pay down your credit card debt with Discover and other issuers.

- Update your income information to reflect any positive changes to your financial situation.

- Ask for a credit line increase during a different time of year. According to a TransUnion study, credit limit increases are more common between January and May.

- Consider applying for a new credit card. Sometimes applying for a new card is the best way to increase your overall credit limit because it can increase the total amount of credit available to you.

Pros and cons of a higher credit limit

While a credit limit increase is usually a positive event in your financial life, there are both advantages and drawbacks to consider.

Pros:

- If you don’t increase your spending, your credit utilization ratio will be lowered, which can improve your credit score.

- More borrowing power offers increased budget flexibility and an opportunity to fund large purchases or urgent expenses.

- Increased spending on a rewards credit card can result in more cash back or points if you pay your bills in full every month.

Cons:

- It’s possible that Discover will pull your credit, adding a hard inquiry to your credit report.

- Having access to more credit can trigger overspending.

Bottom line

A higher credit line can have a positive impact on your financial situation by improving your credit and providing more borrowing power. Requesting a credit limit increase with Discover is simple – be sure it’s the right time to do so and have all the information prepared before you contact the issuer.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.