Summary

Chase Ultimate Rewards points are some of the most flexible and valuable credit card rewards – and once you learn how to transfer them, you’ll be able to stretch them even further.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Chase Ultimate Rewards points are some of the most flexible and valuable credit card rewards out there – and once you learn how to transfer Chase points, you’ll be able to do even more with your rewards.

Many people don’t realize that the Ultimate Rewards program lets you transfer points between Chase credit cards, giving you the opportunity to combine points in a single Chase card account or pool points with another member of your household. You can even transfer your Chase cash back rewards, earning 100 Ultimate Rewards points for every dollar transferred.

Chase’s premium travel credit cards offer even more transfer opportunities, including the chance to increase the value of your points by redeeming them for travel through Ultimate Rewards, as well as the ability to transfer your points to popular travel loyalty programs.

Want to learn more? Let’s look at how to transfer points between Chase cards, how to transfer Chase points to another person and how to make the most out of your Ultimate Rewards points, in general.

How to transfer Chase points

To another Chase account

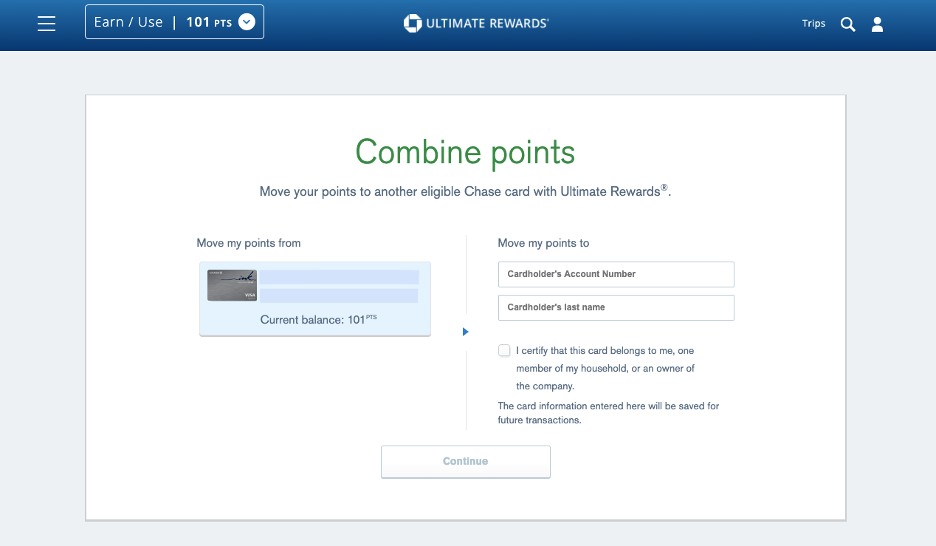

To transfer Chase points to another Chase credit card, log in to your Chase account and look for the option to “Redeem Rewards.” This opens the Ultimate Rewards portal.

Once you’re inside the Ultimate Rewards portal, use the points menu to select “Combine Points.” Enter the credit card number and cardholder last name of the account to which you’d like to transfer your points. Confirm the account belongs to you, a member of your household or an owner of your company (if you are transferring points from a business credit card). Then, select “Continue” to complete the process.

To another Chase cardholder

If you want to know how to transfer Chase points to another person, follow the same steps as indicated above: Log in to your Chase account, select “Redeem Rewards,” open the Ultimate Rewards portal and use the points menu to select “Combine Points.” Enter the other person’s account number and last name, confirm that they are a member of your household and select “Continue” to complete the process.

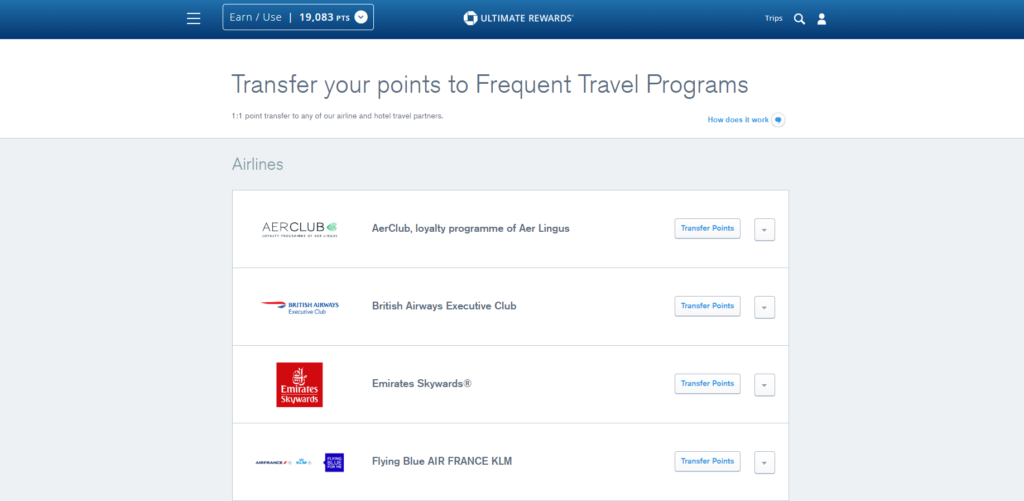

To an airline or hotel rewards program

If you have a Chase credit card that allows you to transfer points to an airline or hotel rewards program, start by logging in to your account and selecting “Redeem Rewards.” From there, use the Ultimate Rewards points menu to select “Transfer to Travel Partners.”

You’ll be able to transfer Chase points to Southwest, United or any of the other travel loyalty programs that are currently partnered with Chase Ultimate Rewards.

Why transfer Chase points?

One of the best ways to manage your Ultimate Rewards points is to transfer points between Chase cards.

If you have 1,000 Ultimate Rewards points on one Chase credit card and 500 points on a second Chase credit card, combining those points gives you 1,500 Ultimate Rewards points to put toward a statement credit, travel purchase or any of the other redemption options Ultimate Rewards offers.

If you have a Chase credit card that earns cash back, you can turn your cash back into points by transferring it to a Chase card that earns Ultimate Rewards points. You’ll earn 100 points for every dollar you transfer.

Select Chase credit cards also allow you to transfer Ultimate Rewards points to travel loyalty programs at a 1:1 rate, which can be an excellent way to take advantage of free hotel stays or work your way toward a free flight.

Where can you transfer Chase points?

All Chase cardholders can transfer Chase Ultimate Rewards points between two of their active Chase credit card accounts. Chase cardholders can also transfer points to another Chase credit card account within the same household.

If you have a premium Chase credit card like the Chase Sapphire Preferred® Card, Chase Sapphire Reserve® or Ink Business Preferred® Credit Card, you can also transfer points to many popular travel loyalty programs – including 11 frequent flyer programs and three hotel programs.

Tips for making the most of a point transfer

Want to know more about how to transfer Chase points? Here are our tips for making the most of your next points transfer:

- Before you book your next trip, transfer your points to the Chase Sapphire Preferred or Chase Sapphire Reserve cards. When you use your Chase Sapphire Preferred to book travel through Chase Ultimate Rewards, your point value will increase by 25%. When you use your Sapphire Reserve, your points value will increase by 50%. This means that 50,000 points can be worth $625 toward travel with the Sapphire Preferred and $750 with the Sapphire Reserve.

- Combine household points before making a big purchase. If you want to redeem your Ultimate Rewards points for a big purchase, try pooling your household’s Chase rewards before you shop. If you’re thinking about buying a new iPhone, for example, you and your spouse or partner can combine cash back or points in a single account and redeem your points at the Apple Ultimate Rewards store.

- Know which redemption options give you the most value. Before you spend your transferred points, take some time to learn which redemption options offer the most value. According to Chase, 100 points are worth a dollar when you redeem them for cash or gift cards – but those same points are only worth $0.80 when you redeem them through Chase Pay.

- Watch for bonus options that allow you to earn more points – or deals that increase the value of your points. Chase’s sign-up bonuses are some of the best in the industry, but those aren’t the only Ultimate Rewards bonuses out there. You can earn as much as 25 bonus points per dollar when you Shop Through Chase, for example. The next time you log in to Chase Ultimate Rewards, see if there’s a way to earn more points – or make your existing points go further.

Should you transfer your Ultimate Rewards?

If you have multiple Chase credit cards, consolidating your Ultimate Rewards points in a single account can be a smart move. Plus, when you transfer your Ultimate Rewards points to the Chase Sapphire Preferred or Reserve card, you have the opportunity to increase the value of those points by redeeming them for travel through Chase Ultimate Rewards.

If you and another member of your household both earn Chase points, pooling those points in one of your accounts can help you consolidate rewards toward a trip, an Apple purchase or another big redemption option. Don’t forget that you can turn Chase cash back rewards into Ultimate Rewards points by transferring your cash to a card that earns points.

The more you know about how to transfer Chase points, the more value you’ll be able to get out of your points. Use these tips to help you with your next Chase points transfer – and see how far your Chase Ultimate Rewards points can go.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.