Summary

Getting approved for a higher credit limit with Chase might be easier than you think, but you should ensure you can preserve your credit in the process.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

There are a lot of great reasons to request a higher credit limit. Asking your card issuer for a larger credit limit can help reduce your overall credit utilization or help you afford a large purchase you plan on paying off over time (though, of course, we caution against getting a credit line boost to take on purchases you can’t afford).

If you own a Chase credit card, the process for requesting a higher credit limit is actually quite simple. It’s even possible to be targeted for a larger credit line without having to specifically request it. Keep reading to learn more about increasing your credit line with Chase.

Eligibility requirements

Although there are no strict requirements for a credit limit increase with most banks, there are some good general principles to keep in mind to improve eligibility. You are more likely to qualify for a credit line increase if the following statements are true:

- You have a good track record of on-time payments.

- You’ve had your account open for at least six months.

By following the above guidelines, you’re showing card issuers that you’re able to use your credit line responsibly. If you’ve demonstrated that you can make your payments on time, every time, it signals to Chase that you can handle a higher limit.

Similarly, you can build a better reputation with a bank by demonstrating these behaviors over an extended period of time. The longer you have an account open with Chase, the more data they have to review and decide if you’re a responsible cardholder. Plus, if you applied for a new card less than six months prior to requesting a credit limit increase, it is unlikely that much has changed on your credit report warrant a higher credit limit.

Before you request a credit limit increase

Before you pursue a credit limit increase, it’s important to keep a few things in mind.

First, you should decide exactly what credit line you’d like to have. In general, we recommend avoiding asking for too much at once – unless you are very confident in making your case for a big increase. For instance, try to avoid requesting too much too fast, such as trying to double your current limit. Boost your chances of approval and minimize the risk of putting yourself in debt by not asking for more than you can easily pay off.

Reviewing your credit report and knowing your credit score before you request a higher credit line is also important. If you know how you look to lenders, you can make a better case for why you deserve a higher limit. Plus, you’ll see any late payments or negative marks that might cause your request to be denied.

Finally, if you’ve been making minimum payments and carrying a balance, you might want to switch up your strategy before requesting a credit line increase. An issuer will be more likely to grant you a higher credit limit if you show the ability to pay back what you borrow.

Process for requesting a credit limit increase

Once you’ve reviewed your credit report and are confident you handle your credit responsibly, you can request a higher credit limit. Luckily, there are a few different ways to get a higher credit line from Chase.

Automatic credit line increases

Occasionally, Chase might increase your credit limit without you having to submit a request. Chase regularly reviews your account and may raise your credit if you have a history of making on-time payments and keeping credit utilization low. However, there is no guarantee you’ll see such an offer, and Chase does not publicize a timeline for when your account might be reviewed.

Targeted offers online

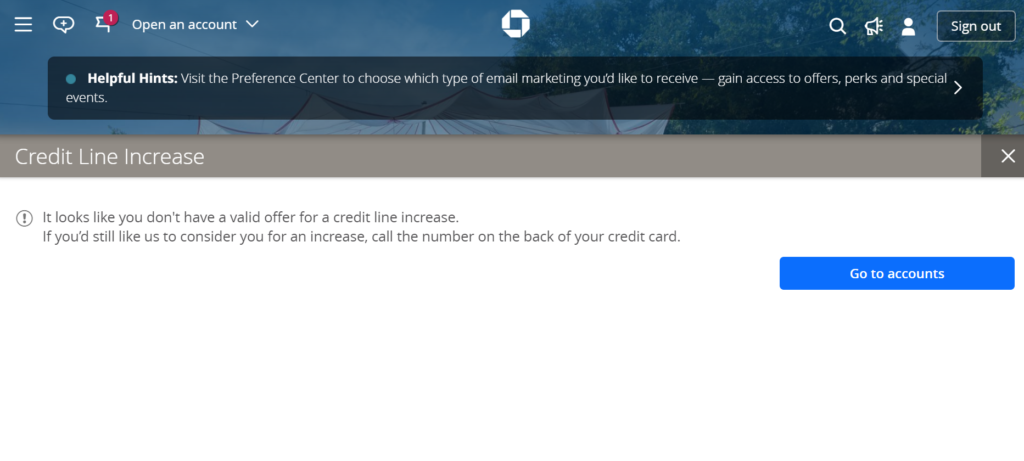

Not every cardholder has the option to request a credit line increase for their Chase card online, but you might be able to score a targeted offer. You can log in to your account here to see if you have any current offers from the bank.

If you don’t receive a targeted offer, however, you’ll have to complete your credit limit request over the phone. Keep in mind that just because you don’t have a targeted offer does not mean you won’t be approved, as Chase seems to extend such offers on a relatively limited basis.

Calling customer service

The final and most common way to get a credit limit increase with Chase is to call the number on the back of your card and request one outright. You should be prepared to make a case for why you deserve the increase.

The representative will likely ask why you need more credit, so have all suitable information readily available. Mention any changes to your situation that might warrant a higher credit limit – such as a raise in your income or a balance you’d like to transfer. You can also leverage your positive history with Chase to better make your case, such as how long you’ve been a customer and your reputation for on-time payments. Further, make sure to avoid requesting a credit limit increase that will result in you taking on more than you can pay off.

If the customer service representative believes you can qualify for a higher credit limit, they will most likely pull your credit report to review your eligibility. You should prepare for a hard pull to your credit, which can result in the loss of a few points from your score.

If your request for a credit limit increase is denied, don’t fret

After you’ve made your case as to why you need an increase to your credit limit, Chase still might decide to deny your request. There are few consequences to being denied for a credit limit increase – especially if they didn’t pull your credit report. Ask the customer service representative why you weren’t approved so you can begin to better your chances for next time.

- Work to slowly improve your credit history by making payments on time and paying off your balance in full whenever possible.

- Pay down any balances on other cards to improve your overall credit utilization.

- Use the card regularly, as Chase may be hesitant to increase the limit on a card you don’t use often.

- Update your income within your online account.

- Consider asking during a different time of year. A 2019 TransUnion study found that credit limit increases are more common between January and May.

- Consider applying for another card with the same bank if you need access to more credit.

Pros and cons of a higher credit limit

If you are still deciding if requesting a credit limit increase is right for you, here’s a quick look at some of the pros and cons of taking advantage of this option with Chase.

Pros:

- You can lower your credit utilization and boost your credit score.

- You’ll have more flexibility to finance large purchases over time.

- You’ll unlock the ability to put more spend on the card, meaning you’ll be able to earn more rewards.

Cons:

- A hard pull to your credit can briefly reduce your score.

- It can be tempting to spend more than you can afford to pay off if you have a higher limit.

- A hard credit pull can limit your ability to qualify for top interest rates on loans and mortgages.

Bottom line

Whether you want to finance a large purchase, transfer a balance to a card with a lower APR or improve your credit score by lowering your credit utilization, requesting a credit limit increase from Chase can be a great move. While there are no strict requirements to be eligible for an increase, it’s important to make sure you’re showing good credit management to lenders. Typically, this is shown through a history of on-time payments and keeping credit utilization low.

Before making a request for a higher credit limit, do your research and carefully consider why this is the best option for you.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.