Summary

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

The COVID-19 crisis was easily the greatest economic disruption since the Second World War and perhaps even the Great Depression.

While there were certainly some winners and some losers, the crisis affected nearly every aspect of our economy, and we are only just now beginning to recover.

As we recover, it’s still unclear how our usage of debit cards has been affected.

See related: What are the differences between a debit card and a credit card?

Debit cards at a glance

According to the 2019 Federal Reserve Payments Study1, “Debit cards, including both prepaid and non-prepaid, were used almost twice as often as credit cards in 2018, but the value of credit card payments exceeded the value of debit card payments by almost 30%.”

One thing you may have noticed since the pandemic is a waning preference for cash among both consumers and merchants.

- A Pew Research Center study cited by CNBC2 noted that nearly a third of U.S. adults now make no cash purchases during an average week.

- On the other hand, a Javelin study commissioned on behalf of ATM operator CardTronics3 – which focuses on the underbanked – shows that cash usage remained at 78% throughout 2020, while credit card usage was at 59%. Debit card use was at 53% as of October 2020.

Credit vs. debit transactions, 2018

| Card type | Number of transactions (billions) | Value ($ billions) | Average transaction value ($) |

|---|---|---|---|

| Debit cards | 86.4 | 3.1 | 36 |

| Credit cards | 44.7 | 3.98 | 89 |

Source: Federal Reserve, January 2020

Current debit card usage tends

Visa and Mastercard are the two dominant payment processors of both debit and credit cards, and they both offer quarterly analyses of spending trends.

- In Visa’s Operational Performance Data4 report for the three months ending on Dec. 31, 2020, it reports $741 billion in U.S. debit transaction volume, a 17.4% increase over the previous year. It compares to $542 billion in credit card volume.

- For its part, Mastercard reported in its Supplemental Operational Performance Data for Q15 2021 $318 billion in U.S. debit and prepaid transactions versus $226 billion in credit and charge programs. This represented a 26.3% growth in credit cards but a 0.5% drop in debit and charge card volume.

How Americans use debit cards

One perspective comes from Telis Demos at The Wall Street Journal6, who noted that the debit card payment and purchase volumes of Visa and Mastercard rose 23% year over year in Q3 of 2020 compared to 2019, while credit card usage was down by 8%. The Journal speculates that this may have been due to reduced access to credit during the coronavirus pandemic, moves to contactless payments and reduced cross-border travel and reduced online spending at the time.

But Forbes’s Ron Shevlin disagrees that credit card usage is down in comparison to debit cards7. He points out that as the economy has recovered, there has been a $100 billion increase in credit card payment volume, compared to just an $80 billion in debit cards between the second and third quarters of 2020.

He also believes that the shift to mobile payments was behind the trend toward debit spending and not a preference for debit. That’s because debit cards were nearly twice as likely to be linked to Google Pay or Apple Pay than credit cards.

Shevlin also cited a study from Cornerstone Advisors that shows 57% of the approximately 22 million Gen Zers between 21 and 25 years old have at least one credit card, with 25% holding two or more.

In its 2020 Survey of Consumer Choice, released in 2021, the Federal Reserve Bank of Atlanta reports that:

- U.S. consumers made 68 payments per month on average in 2020, which was unchanged from 2019.

- On average, debit cards were used most often for 23 of those payments, followed by credit cards (18 payments) and cash (14 payments).

- Ninety-seven percent of consumers had some type of payment card (debit, credit or prepaid), with 85% owning a debit card.

- Sixty-eight percent of consumers used a debit card each month, compared to 74% using cash and 63% using credit cards8.

See related: Are cash back debit cards worth it?

Cryptocurrency’s impact on debit card use

As cryptocurrency gains in popularity, it’s starting to impact debit card use.

- According to the PYMNTS Next-Gen Debit Tracker report,9 16% of U.S. consumers own or have owned cryptocurrency and 51% are more likely to shop with a merchant that accepts it.

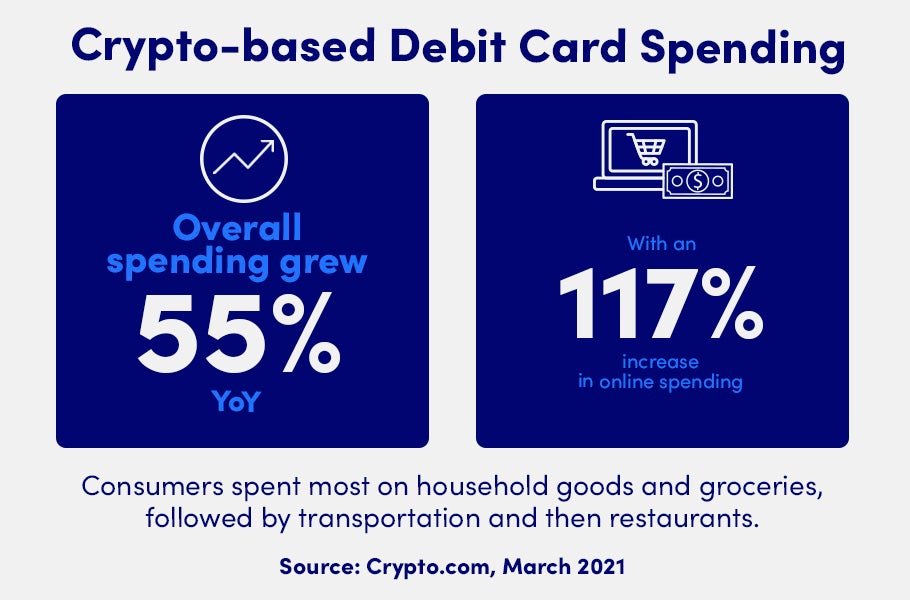

- One of the early crypto-based debit cards is the Crypto.com Visa. Crypto.com reports that spending grew 55% per user in 2020, with online spending up 117%10.

- Data presented by Crypto Parrot and reported by the Fintech Times11 in February 2021 indicate that global keyword searches for “crypto debit card” had surged by 194% over the past 12 months on Google. The interest attained a peak popularity score of 100 in February, while a year before, it was at 34.

See related: Are crypto credit cards a safe way to get into cryptocurrencies?

Debit card fraud

One negative trend that worsened during the COVID crisis was payment fraud and other forms of cybercrime.

According to Mercator Advisory Group’s 2020 North American PaymentsInsights report12, debit card fraud increased, with one-quarter of debit card owners reporting fraud on their card in 2020. This was similar to 2019 but is still much higher than the 17% reported in 2018.

A May 2021 report by the Board of Governors of the Federal Reserve Systems13 found that “Across all debit and general-use prepaid card transactions for covered issuers, fraud losses to all parties as a share of the transaction value were 12.4 basis points in 2019, or $12.40 per $10,000 in transaction value.”

The Fed reported a steady increase in fraud losses from 7.8 basis points in 2011 and 11.2 basis points in 2017. The average loss per fraudulent transaction changed little between 2017 and 2019, but the number of fraudulent transactions increased.

Credit card users are protected by the Fair Credit Billing Act, which has protections that don’t apply when you use a debit card. Perhaps that’s why the January 2021 PYMNTS report on Online Security and the Debit-Credit Divide14 found that protection against theft of funds is a motivating factor for 35% of credit card users, which was twice the amount cited by debit card users. And when it came to data security, 27% of credit card users cited this as a motivating factor, compared to just 14% of debit card users.

Another factor in choosing debit versus credit was rewards, which motivated 57% of credit card users, but only a small fraction of debit and PayPal users. The report also found that 24% of those using debit less cite concerns that their payment information could be stolen, while just 14% of those who have cut back their credit card use online cite this concern. The report speculated that this is due to debit cards being directly linked to user’s bank accounts.

Bottom line

So much has changed in the U.S. economy since the COVID pandemic began, with some trends being reversed and others being accelerated. By taking a closer look at debit card usage statistics and analysis, you’ll gain a greater understanding of where we are and where we’re going with this ubiquitous form of payment.

Sources

- 2019 Federal Reserve Payments Study, January 2020

- CNBC, “The coronavirus pandemic has caused a surge in demand for contactless payments, accelerating the shift from cash to digital options,” December 2020

- CardTronics, “The health of cash and its role expanding the digital economy,” April 2021

- Visa Operational Performance Data, Q4 2020

- Mastercard Supplemental Operational Performance Data, Q1 2021

- Wall Street Journal, “Payments Companies Give Credit Where It’s Due – to Debit,” November 2020

- Forbes, “The Impending Credit Card Boom: Why Millennials and Gen Z Will Use Credit Cards More Than Debit Cards,” November 2020

- Federal Reserve Bank of Atlanta, 2020 Survey of Consumer Payment Choice, 2021

- PYMNTS Next-Gen Debit Tracker, June 2021

- Crypto.com, “Crypto.com Visa Card Spending Grew 55% Per User in 2020, Online Spending Up 117%,” March 2021

- The Fintech Times, “Crypto Parrot finds demand for crypto debit cards surges 194% in 12 months,” February 2021

- Mercator Advisory Group, 2020 North American PaymentsInsights: Debit – Continued Change, December 2020

- Board of Governors of the Federal Reserve Systems, 2019 Interchange Fee Revenue, Covered Issuer Costs, and Covered Issuer and Merchant Fraud Losses Related to Debit Card Transactions, May 2021

- PYMNTS, Online Security and the Debit-Credit Divide, January 2021

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.