Summary

If you can’t afford to pay for something outright or you’re not sure you’ll want to keep a purchase for the long haul, Acima’s rent-to-own financing plans could be worth considering.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

From Aaron’s to Buddy’s Home Furnishings to Rent-A-Center, the rent-to-own industry has long catered to consumers who need to buy something quickly but are short on cash or have limited access to traditional credit.

In recent years, chains like Kmart and Best Buy have joined the fray with their own in-house leasing programs. As a result, shoppers today have more payment solutions at their fingertips than ever — including Acima Credit, which partners with merchants big and small to offer lease-purchase options at the point of sale.

Rent-to-own financing isn’t right for everyone, as it can be much more expensive than buying the item outright, but it can be a fast and easy way to get your hands on the stuff you need, when you need it. Plus, you don’t need good credit to be approved, and paying on time can boost your score. Here’s what you should know about Acima Credit.

What is Acima?

Acima is a financing company that provides lease-to-own programs at a wide array of online and brick-and-mortar retailers. As an alternative to credit cards and conventional lenders, Acima offers eligible customers flexible payment plans and leasing options.

Whether you have your eye on a big-ticket item or just want to test something out before you commit to owning it, Acima can help you shop for the things you need without having to fork over the full price upfront. And if you change your mind about a particular purchase, you can terminate the lease early, without paying a penalty.

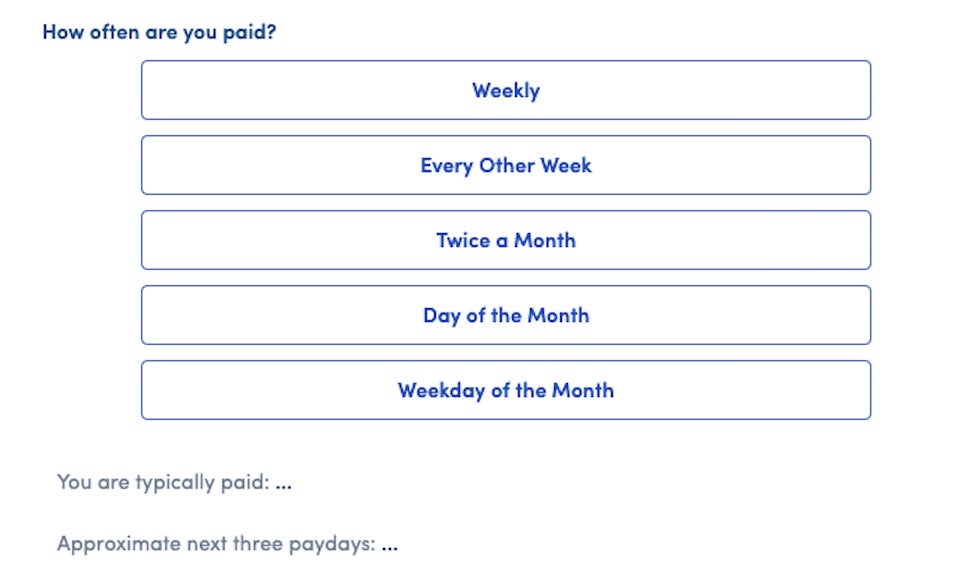

Payment schedules are based on when you get paid, with options for weekly, biweekly, twice-monthly or monthly due dates. Acima lease terms are 12, 18 or 24 months, after which you’ll own the merchandise free and clear. (You can also choose to pay your balance in full at any time during your lease to save on total costs – more on that later.)

How Acima works

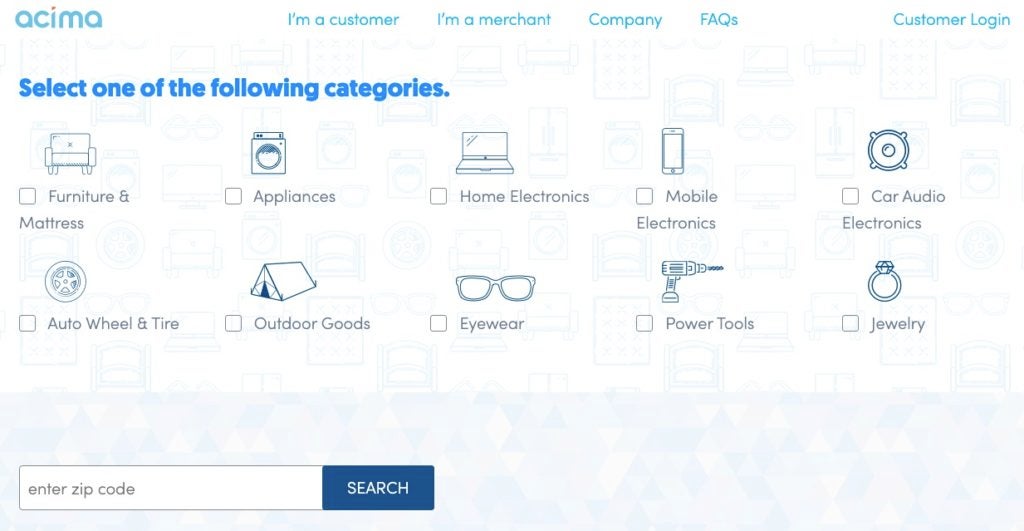

Unlike some other pay-over-time services, using Acima isn’t as simple as clicking a box at checkout. To apply for a lease-purchase plan with Acima, you’ll first need to find a participating store by visiting the Acima website, punching in your ZIP code and selecting one of the following shopping categories: furniture and mattress, appliances, home electronics, mobile electronics, car audio electronics, auto wheel and tire, outdoor goods, eyewear or power tools and jewelry.

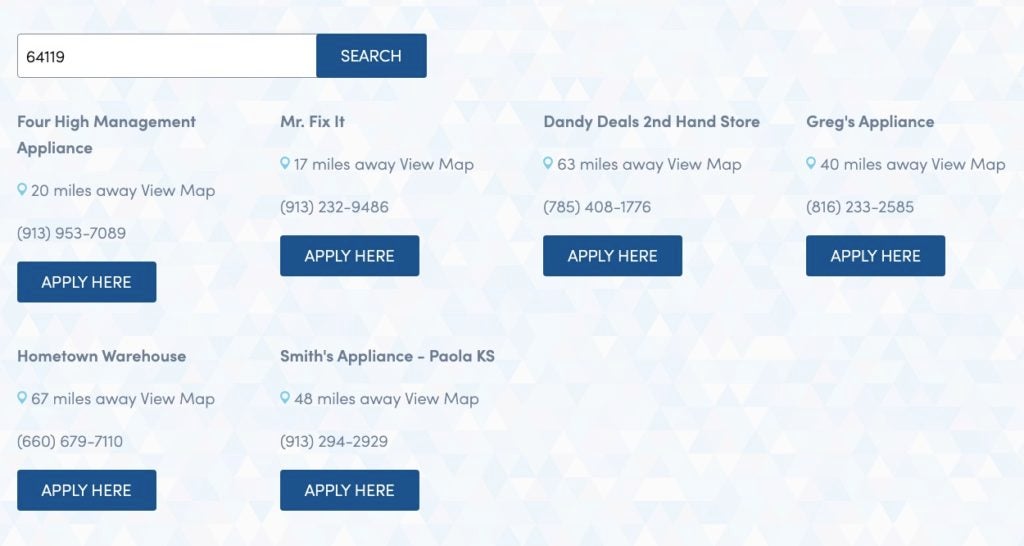

Note: Merchants that partner with Acima are typically locally owned, so you’re unlikely to see the likes of Walmart or Target in your search results.

Once you find a store that meets your purchase needs, click on “Apply Here” under the merchant info to submit a free application online. Alternatively, you can visit the store to apply in person.

As with most credit applications, you’ll need provide some basic information about your identity and income. In addition to being at least 18 years old, Acima’s eligibility guidelines require you to have the following:

- An active checking account with monthly deposits of at least $1,000, with no excessive overdrafts or negative balances

- At least three months of income history with your current employer (or other income source)

- A government-issued photo ID

- A Social Security number or an ITIN (individual taxpayer identification number)

While you don’t need a good credit score to qualify for an Acima lease, the company does a soft pull of your credit report as part of evaluating your application. (Soft inquiries have no impact to your credit score.) On its website, Acima says it looks at “multiple data points” to make a lending decision. It also says it “regularly approve[s] customers who have little or no consumer report history or credit score.”

Acima offers lease-purchase plans for items valued between $500 and $5,000, with term lengths of 12, 18 or 24 months. Total lease amounts are based on the price of the merchandise plus “the cost of the lease services,” which is essentially Acima’s version of interest.

Once you’re approved (you’ll typically receive a decision in seconds), you pick out the merchandise you want at the merchant you applied with. Acima buys the item(s) and rents them to you until you make all of your lease payments or exercise one of these early purchase options:

- In the first 90 days, you pay the lease amount of the item plus a $10 buyout fee. You’re also out of pocket for the initial payment (usually $50) collected by the merchant at the point of sale, which is required before you can take possession of the merchandise.

- After 90 days (but before the end of your lease), you pay a lump-sum percentage of the remaining lease amount, generally 65%.

Again, you also have the option to return your stuff and terminate the lease at any time, without penalty.

Payments are set up automatically to align with your paydays, with options for weekly, biweekly, twice-monthly or monthly due dates based on info you provide on your application:

Each approval lasts for 90 days and expires automatically if you don’t sign a lease agreement within that timeframe. Note that each approval is only good at the store with which you originally applied. If you decide to shop somewhere else, you’ll need to reapply (which cancels your first approval, as you can only have one active approval at a time).

Pros and cons of paying with Acima

If you elect to make all of your payments for the life of your Acima lease, you could end up paying about twice what you would have paid in cash by the time you’re done, making this a potentially pricey way to shop. That said, Acima can be a good option for people with bad or no credit and who need to purchase something now. Here are some of the pros and cons of using the leasing service:

Pros

- Acima uses a soft pull to access your consumer report, which doesn’t impact your credit score.

- Approval is fast, and you can take possession of the merchandise as soon as you sign your lease agreement and make your initial payment to the participating merchant.

- Billing due dates aligned with your paydays can help you budget more easily.

- You have the option to set up autopay using your checking account, debit card or credit card.

- You can change your payment frequency at any time after your first lease payment.

- There’s no penalty for terminating your lease early.

- Acima reports your lease activity to Experian, which can help you build credit if you keep your account in good standing.

Cons

- Failed or late lease payments can incur fees, increasing your out-of-pocket costs and potentially hurting your credit score.

- Lease approvals are specific to the merchant through which you applied. If you change your mind about where to shop, you’ll have to start the application process over.

- How much you’ll pay in interest can be unclear, as Acima charges for “the cost of the lease services” versus stating a traditional APR.

- Merchandise returns during the first 60 days are at the discretion of the retailer. After 60 days, you’ll have to contact Acima directly to arrange pickup.

- You won’t receive billing statements to remind you of your payment due date. (However, you can check your remaining balance online and call Acima’s customer service to have a physical copy of your statement mailed to you.)

Tips for maximizing Acima

If you decide to take advantage of Acima’s lease-payment program, keep the following tips in mind to make the most of your approval.

Use Acima for “needs” versus “wants”

Acima can be a pricey way to buy the things you need, so try to limit your shopping to exactly that: “needs” versus “wants.” For example, replacing a broken washing machine or buying a set of tires for winter is probably a better use of an Acima lease than, say, purchasing a brand-new flat-screen TV.

Beware the fine print

Read your lease agreement in full before you sign it. Take note of the total lease amount, which is the sum of all payments over the full 12-, 18- or 24-month term. (That’s how much you’ll pay if you don’t use one of the early purchase options.) The contract will also list other potential charges you could face, including those for lost or damaged property, repossession, collection and redelivery fees.

Exercise the 90-day early purchase option if you can

Pay off your Acima lease early whenever possible, preferably within the first 90 days. Otherwise, the price of the merchandise could end up being double what you would have paid by purchasing the item in cash.

Pay on time

Because late or returned payments could result in extra fees (not to mention hurt your credit), use autopay and make sure you have enough money in your account to cover the withdrawal.

Keep an eye on your credit

Maintaining an on-time payment history with Acima can boost your credit score over time, so take a peek at your credit report regularly. At some point, you may qualify for a regular credit card or personal loan, both of which are likely to be a more affordable means of financing your purchases than an Acima lease.

Final thoughts

Acima and other rent-to-own financing companies like it can fulfill the needs of a certain subset of shoppers. However, consumer advocates have long warned against the darker side of the rent-to-own business model. If you decide to use Acima’s lease-purchase program, don’t borrow more than you can afford, and make every effort to pay off your lease early to save as much money as possible.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.