Summary

FlexPay lets you split your online cart into interest-free monthly payments – but you can only use it for purchases from the Home Shopping Network (HSN).

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

If you’ve ever had a bit of insomnia – or if you simply consider yourself a night owl – chances are you have some familiarity with home-shopping channels.

We’ve all been there, scrolling mindlessly through TV programs until we come across a particularly energetic host, speaking directly to you from a brightly lit studio as they present products like cookware, beauty and skincare items, clothing, electronics and more.

Even if you don’t buy anything, it’s easy to become entranced by the persuasive sales pitches. This was especially true when the items were only available for purchase while they appeared on screen, as was the case with Home Shopping Network (HSN) when it launched on a local Florida station in the 1980s.

Of course, times have changed considerably since then, but the ability to shop from the comfort of home has always been highly desirable.

Today, HSN programming is available 24/7 via cable TV and directly on its website. As online shopping becomes even more prevalent during the coronavirus pandemic, you might be looking for another option for getting your hands on the things you need, as well as paying for them in a way that works for you. And with HSN’s FlexPay, you might be able to enjoy the best of both worlds. Here’s what you need to know about it.

See related: Best credit cards for online shopping

Paying over time with FlexPay: Things to know

What is FlexPay?

Similar to alternative installment plans such as Afterpay and QuadPay, HSN’s FlexPay lets you pay for your HSN shopping haul in up to five monthly payments, with no additional fees or interest charges. By selecting the FlexPay option at checkout on the HSN website, you can break down the cost of your purchases into more manageable installments, without waiting to receive them until they’re paid for in full.

While that sounds like a win-win, there are a few things you should know about FlexPay before you start adding stuff to your cart. Keep scrolling to learn more about how FlexPay works, its pros and cons and how you can make the most out of this installment payment plan.

How FlexPay works

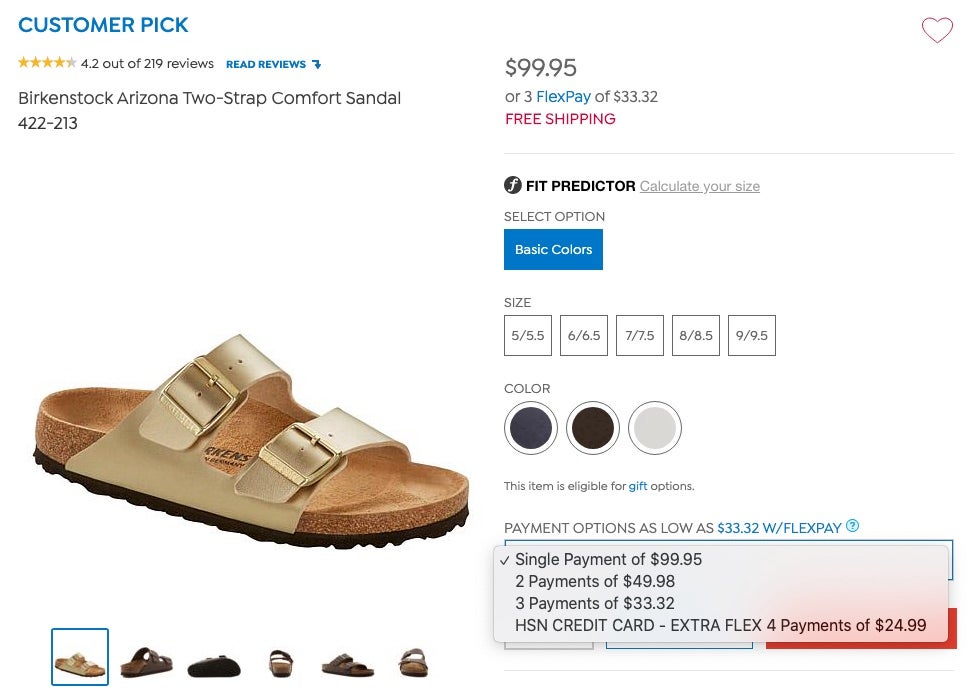

Using FlexPay is a pretty straightforward process. If you find an item you’d like to purchase on the HSN website, you can tell right away whether it’s eligible for FlexPay based on the payment options. As an example, here’s what it looks like on a pair of Birkenstock sandals:

When you click through to the item, there’s a drop-down menu that lists all the ways you can pay. At the time of writing, for the Birkenstocks, you can choose from a one-time $99.95 payment, two FlexPays of $49.98 or three FlexPays of $33.32. (The amount and number of FlexPays you’ll be offered depends on the item and the total cost of your order.)

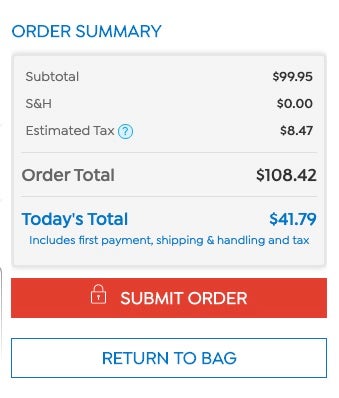

Let’s say you want to spread the cost of your new sandals over three months. Pick that payment option in the drop-down menu and click “Add to Bag.” Then click through the standard check out process.

Enter the details of the credit or debit card you want to use for your monthly FlexPays (PayPal is another option) and click “Continue” to proceed to the final order review.

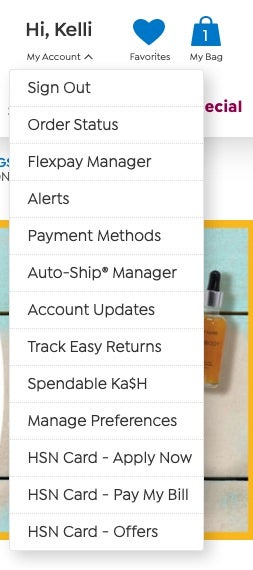

That’s all there is to it. If your FlexPay request is approved, all future FlexPays will automatically bill to your original payment method every 30 days (beginning 30 days from your order date) until it’s paid in full. You can conveniently manage your FlexPay orders directly in your HSN account. Just sign in and select “FlexPay Manager”:

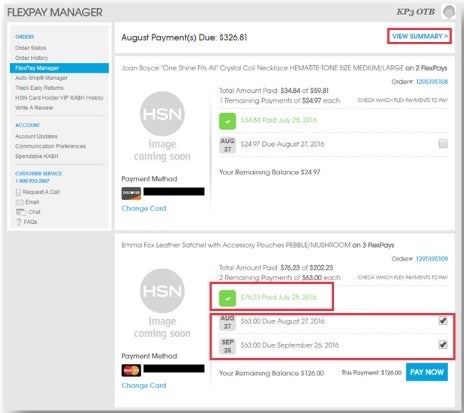

FlexPay Manager lets you review your upcoming payments, change your payment method and even pay off your purchase early (with no penalty).

Each FlexPay request is evaluated at the time of purchase, so just because you’ve been approved before doesn’t mean you will again. The opposite is also true – if you’ve been declined, you’re encouraged to try FlexPay again in the future. If HSN is unable to approve your FlexPay order, it will send you a written explanation within seven to 10 days.

Pros and cons of paying with FlexPay

While FlexPay can be a fast and convenient payment option, that doesn’t mean it’s right for everyone, particularly if one of your main goals is building or rebuilding credit. Here are some pros and cons of using the service:

Pros

- Buy what you need now and pay off your purchase over time, without accruing interest or fees.

- Fixed monthly payments provide predictability for your budget.

- HSN offers no-hassle 30-day returns on FlexPay purchases.

- Review your upcoming installments, change your payment card or pay off your FlexPay purchases early (with no penalty) using FlexPay Manager.

- If you also have an HSN credit card, you can take advantage of “ExtraFlex,” which adds another month to your FlexPay plan (and therefore lowers your monthly payment amount).

Cons

- You can’t use FlexPay to build credit, as your payments aren’t reported to the credit bureaus.

- It’s unclear whether HSN pulls your credit report on FlexPay orders, which could potentially hurt your credit score if it results in a hard inquiry.

- Not all HSN items qualify for FlexPay. Exclusions include cell phones over $500, jewelry over $1,000, gift cards, auto-ships and more.

- FlexPay cannot be combined with VIP Financing, a promotional deferred-interest payment plan for HSN cardholders.

- HSN has a reputation for providing poor customer service. Some users have reported being denied for FlexPay but still having their first payment go through, requiring them to wait for a refund.

Tips for maximizing FlexPay

To get the most out of FlexPay (and shopping with HSN), keep the following tips in mind.

Be strategic about your payment card

If you use a rewards credit card for your FlexPay installments, you can earn points or cash back on your purchases. But if you think there’s a chance you won’t be able to pay your credit card bill in full every month, use a debit card instead to eliminate the potential for interest charges.

Don’t spend beyond your means

While there are no fees or interest charges with FlexPay, you may be tempted to spend more if you don’t have to pay for all of your purchases in one lump sum. Think about your budget and the kind of monthly payments you can afford before you buy.

Compare prices first

Sometimes HSN prices are higher than what you’d pay for the same item at other retailers. Prior to checkout, check the price of the items you’re considering on Amazon and department store websites. You may be able to find it cheaper elsewhere, even if it means you can’t use FlexPay to pay for it.

Be patient

A cursory look through the conversations in the HSN Community found that some shoppers have paid full price for their purchase, only to see HSN put the same item on clearance not long afterward. Unless it’s something you really can’t wait to order, add the item to your favorites and see if the price drops in a couple of weeks.

Final thoughts

With no interest or fees, FlexPay can be a cost-effective alternative to using a regular credit card to pay for stuff, especially if you’re worried about racking up debt. Remember: If you’re trying to build or rebuild credit, FlexPay won’t help you get there. But if all you want is an easy way to break down the cost of your purchases into smaller monthly payments, FlexPay could be worth exploring.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.