| Rewards Rating: | 3.2 / 5 |

| Rewards Value: | 2.0 |

| APR: | 2.0 |

| Rewards Flexibility: | 2.0 |

| Features: | 3.0 |

| Issuer Customer Experience: | 4.0 |

In a Nutshell:

Though this card may make sense for big Disney fans, its middling rewards rates and flexibility make its annual fee hard to justify for the average person.

Rewards Rate

|  |

Introductory Bonus [Average]

|  |

Annual Bonus

|  |

Annual Fee $49 |  |

APR

|  |

Chase Customer Service Ratings

|  |

Other notable features: Introductory APR for select Disney vacation packages; 10% off select merchandise purchases at select locations and 10% off select dining locations most days at the Disneyland® Resort and Walt Disney World® Resort; 10% on select purchases at DisneyStore.com

The Disney® Premier Visa® Card can seem attractive at first glance if you’re a true Disney loyalist, and it’s easy to see why. Not only does it offer a sign-up bonus that’s competitive among comparable cards, but its rewards come in the form of Disney Dollars that can be used for Disney vacations and other redemptions from the Disney brand.

This means the Disney® Premier Visa® Card can help families start saving up for an expensive Disney vacation through regular spending and bills. However, the card’s $49 annual fee will eat away at the rewards earned over time, and the high APR can make carrying a balance expensive.

Because of the carrying costs for this card, we believe the Disney® Premier Visa® Card is best for families who spend enough to earn a considerable amount in rewards and plan to pay their balance in full each month. Read on to find out other reasons why you might want to sign up for this card and why you might prefer to skip it in favor of a different rewards credit card altogether.

Pros

Cons

Why you might want the Disney® Premier Visa® Card

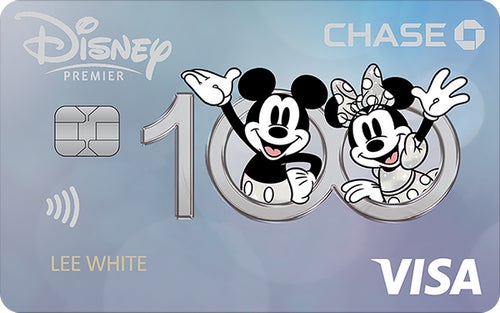

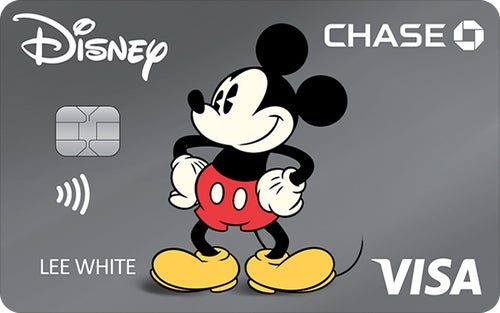

You might want the Disney® Premier Visa® Card just so you can have a credit card with an image of Darth Vader emblazoned on the front, and that’s perfectly okay. However, there are other reasons to consider this card that extend far beyond the Disney card designs you get to choose from.

Generous sign-up bonus

This card starts you off with a $200 Disney Gift Card eGift to use today upon approval + earn a $100 statement credit after you spend $500 on purchases in the first 3 months from account opening. This can be used for Disney vacations and other types of spending through the Disney brand.

Disney Bundle credit

Cardholders also qualify for a statement credit of up to $13.99 per month for up to three consecutive months when they subscribe to the qualifying Disney Bundle Trio subscription, or other qualifying subscriptions or add-ons purchased directly at Disneyplus.com, Hulu.com or Plus.espn.com as long as they total $12.99 per month or more. The subscription must be paid with the Disney® Premier Visa® Card to qualify.

Exceptional rewards rate on certain Disney purchases

This card earns 5% in Disney Rewards Dollars on purchases made directly at DisneyPlus.com, Hulu.com or ESPNPlus.com, which can add up over time. Cardholders can also earn 2% in Disney Rewards Dollars at most Disney U.S. locations, as well as on purchases at gas stations, grocery stores and restaurants.

Qualify for Disney perks

Several Disney perks come automatically with this card, including discounts on select Disney merchandise (terms apply), discounts on dining at Disney resorts and even discounts on select guided tours at eligible Disney properties. Cardholders also get 10% off eligible credit card purchases at DisneyStore.com

Why you might want a different card

While the reasons above are good ones if you’re considering the Disney® Premier Visa® Card, there are plenty of other reasons to consider a different rewards credit card. After all, most cash back credit cards let you redeem rewards for statement credits, which you could ultimately use to help pay for a Disney vacation if that’s what you’re after.

Lackluster rewards rate for most purchases

The 2% rewards rate on purchases at gas stations, grocery stores, restaurants and most Disney U.S. locations this card offers is okay, but several cash back credit cards offer 2% cash back on everything you buy. Not only that, but the Disney® Premier Visa® Card offers a disappointing rewards rate of 1% back on regular spending.

Inflexible redemptions for rewards

This card earns Disney Rewards Dollars, which can be redeemed for theme park tickets, resort stays, Disney shopping and other eligible Disney purchases. You can also redeem rewards for airline statement credits at a rate of one cent per point. That said, you have to load your card rewards onto a Redemption Card before you can use them. You also need a minimum of $20 Disney Rewards Dollars to do so.

In the meantime, other cash back credit cards let users redeem for more flexible options like statement credits and cash back transferred to a bank account. Many other cash back credit cards also let you redeem for statement credits in any amount without a minimum threshold.

Too many fees

Not only does the Disney® Premier Visa® Card require a $49 annual fee, but it also charges foreign transaction fees. The card also has a high variable APR, and no intro APR offer for regular purchases or balance transfers.

Disappointing 0% intro offer for Disney vacations

While the Disney® Premier Visa® Card offers 0% APR on Disney vacation packages and Disney Vacation Club® Resort memberships booked with the card, this benefit only lasts for six months. After that, the regular 18.24% - 27.74% Variable APR applies.

By comparison, you can find a range of cash back credit cards that offer 0% APR on purchases, balance transfers or both for up to 15 months.

How does the Disney® Premier Visa® Card compare to other rewards credit cards?

|  |  | |

|---|---|---|---|

Rewards rate

| Rewards rate

| Rewards rate

| |

Welcome bonus

| Welcome bonus | Welcome bonus

| |

Introductory APR

| Introductory APR

| Introductory APR

| |

Regular APR 18.49%, 24.49%, or 28.49% Variable APR | Regular APR 18.24% - 27.74% Variable

| Regular APR 18.24% - 27.74% Variable

| |

| Annual fee $0 | Annual fee $0 | Annual fee $0 | |

| Other things to know Comes with cell phone protection

| Other things to know Comes with purchase protection, extended warranties, trip cancellation and interruption insurance and secondary auto rental coverage

| Other things to know Comes with a range of discounts on Disney dining, select guided tours and Disney merchandise Also comes with baggage protection, purchase protection against damage or theft and extended warranty protection |

Disney® Premier Visa® Card vs. Wells Fargo Active Cash® Card

The Wells Fargo Active Cash® Card offers users a flat rate of 2% cash rewards on purchases with no annual fee. Plus, it comes with 0% intro APR for 12 months from account opening for purchases and qualifying balance transfers, followed by a 18.49%, 24.49%, or 28.49% Variable APR. This makes it a good option for earning generous rewards on purchases, and even charging a Disney vacation and paying it down interest-free for a year.

You can redeem your rewards for statement credits, transfers to an eligible Wells Fargo account, gift cards and more.

Disney® Premier Visa® Card vs. Chase Freedom Unlimited® credit card

The Chase Freedom Unlimited® credit card is also worth considering if you want to earn more rewards on regular purchases and avoid paying an annual fee. This card offers a flat rate of 1.5% cash back on all non-bonus purchases, plus 3% back on dining and drugstore spending and 5% back on eligible travel purchases through Chase Travel.

Better yet, new cardholders qualify for 0% intro APR on purchases and balance transfers for 15 months, followed by a 18.24% - 27.74% Variable APR. Rewards can be redeemed for cash back, statement credits, gift cards, merchandise and more.

Disney® Premier Visa® Card vs. Disney® Visa® Card

If you really want a co-branded Disney credit card but you don’t want to pay an annual fee, check out the Disney® Visa® Card. This card charges $0 in annual fees each year, yet you’ll earn a smaller welcome offer and a lower rate of just 1% back in Disney Rewards Dollars on all purchases.

How to use the Disney® Premier Visa® Card

If you have your heart set on the Disney® Premier Visa® Card but you want to make the most of it, consider this list of tips and tricks.

- Set your card as your preferred payment method for eligible subscriptions. To take advantage of the Disney bundle credit offer, you’ll need to set your card up as your preferred payment method for eligible subscriptions. You’ll want to anyway since the Disney® Premier Visa® Card offers 5% back on purchases made directly at DisneyPlus.com, Hulu.com or ESPNPlus.com.

- Use your Disney® Premier Visa® Card for purchases that earn 2% back or more. We recommend using this card in its 5% and 2% cash back categories as much as you can since doing so will help you boost your rewards haul over time.

- Switch to a flat-rate cash back credit card for other, non-bonus spending. In the meantime, switch to a flat-rate cash back credit card that earns at least 1.5% or 2% cash back for other purchases.

- Pay your balance in full every month. This card’s high variable APR makes it a poor option for carrying a balance, so only charge purchases you can afford to pay off completely. Also make sure to pay your bill on time each month.

- Refer friends to earn more rewards. Finally, Chase and Disney let cardmembers refer friends and get 100 Disney Rewards Dollars for each one (up to 5) that gets approved. This is a good way to earn more rewards over time without extra spending on your card.

Is the Disney® Premier Visa® Card right for you?

The Disney® Premier Visa® Card is not the most lucrative rewards credit card available today, but it makes sense why some people still sign up. It’s nice to have a credit card with so many Disney designs to choose from, and the Disney discounts you get as a cardholder can add up quickly if you’re always spending money with the Disney brand.

That said, it’s important to recognize that you’re giving something up to get a card that’s co-branded with Disney. After all, many credit cards have better rewards rates and intro offers, plus a lot more flexibility when it comes to redeeming rewards.

All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

Responses to comments in the discussion section below are not provided, reviewed, approved, endorsed or commissioned by our financial partners. It is not our partner’s responsibility to ensure all posts or questions are answered.