Summary

This December report by CreditCards.com examines consumer spending habits through the end of 2024, focusing on the role economic factors and uncertainty play, particularly with President-elect Donald Trump set to take office. Key findings: 30% of shoppers will make more purchases than usual this holiday season Top motivation for increased…

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

This December report by CreditCards.com examines consumer spending habits through the end of 2024, focusing on the role economic factors and uncertainty play, particularly with President-elect Donald Trump set to take office.

Key findings:

- 30% of shoppers will make more purchases than usual this holiday season

- Top motivation for increased spending is fear of rising prices due to Trump’s tariffs

- 22% of Americans plan to make a large purchase before the end of the year, many are motivated to buy ahead of Trump’s tariffs

- 34% of respondents say they are “doom spending,” and stockpiling items due to feeling fearful or uncertain about the future

- 30% are likely to go into or worsen debt to secure purchases now

Fear of Trump’s Tariffs Is Fueling More Purchases Than Usual This Holiday Season

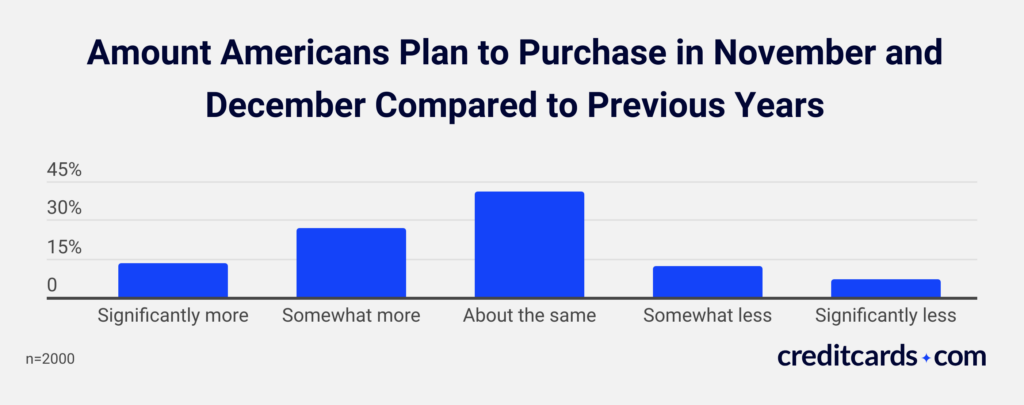

This November and December, 30% of shoppers plan to stock up more than usual. A total of 13% reported they plan to buy significantly more items and 27% somewhat more than they typically do during the holiday season. Meanwhile, 41% expect to purchase about the same amount, and 19% will buy less than in previous years.

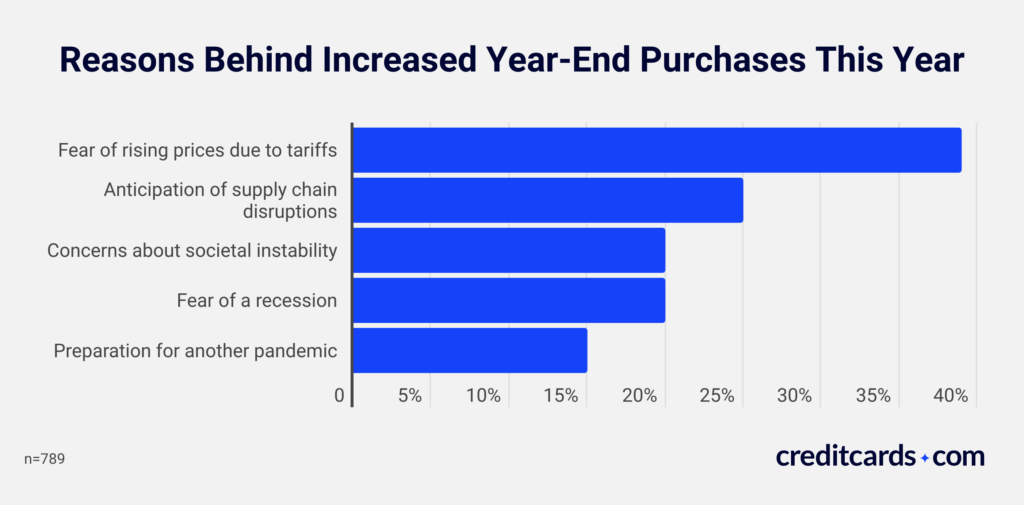

The motivations behind this surge in holiday spending reveal various concerns. Fear of rising prices due to tariffs is the leading factor, cited by 39% of respondents increasing their purchases. Additionally, 25% are worried about potential supply chain disruptions, while 20% are concerned about societal instability. Finally, 20% are buying more due to fear of a recession, and 15% are purchasing more to prepare for another pandemic.

Three-quarters (76%) of respondents are actively seeking holiday sales this year, 84% of whom say inflation is motivating them to hunt for discounts. Among those shopping sales, 36% say most items they buy through the end of the year will be discounted, while 38% expect to purchase many items on sale.

Americans will use holiday deals to secure large purchases ahead of Trump’s tariffs

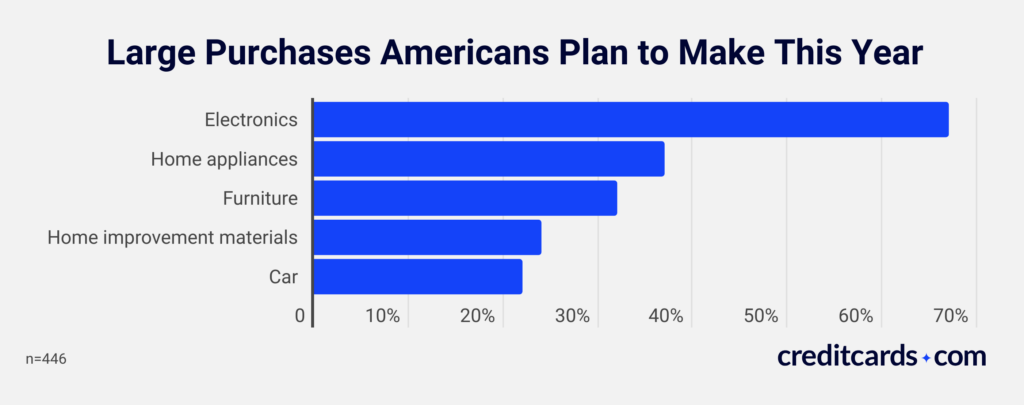

As the year ends, 22% of respondents plan to make a large purchase, while 53% do not, and 24% remain unsure. Among those planning significant purchases, 67% will buy electronics, 37% will seek home appliances, 32% will buy furniture, 24% will purchase home improvement materials, and 22% will seek cars.

Holiday deals play a crucial role in these decisions. Of those planning large purchases, 57% will definitely use holiday discounts, 35% probably will, 6% are unsure, and 3% are unlikely to take advantage of deals.

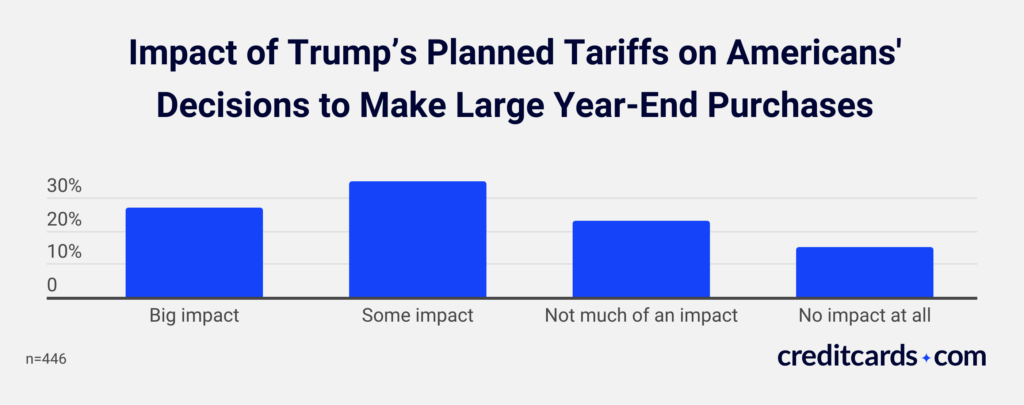

Trump’s planned tariffs are influencing the timing of these purchases. Among respondents, 27% say the tariffs greatly impact their decision to buy now, while 35% report some impact.

“How consumers perceive the state of the economy — such as economic growth, interest rates, stock market shifts, unemployment, and inflation — impacts current and future spending decisions,” says John Egan, credit cards, insurance, and personal finance expert contributor at CreditCards.com.

“Economic sentiment and purchasing decisions haven’t always been aligned since the pandemic ended, though. Some consumers, particularly those influenced by presidential politics and economic news, have remained pessimistic about the economy despite data indicating the post-pandemic economy has improved. Nonetheless, overall consumer spending has gone up recently, thanks in part to rising wages and low unemployment.”

According to Egan, for many Americans, the pending tariffs are bound to contribute to consumer sentiment and consumer spending decisions.

“With the possibility of tariffs hanging over cheap goods from countries like China and Mexico, it’s no surprise that some consumers are pondering big-ticket purchases before President-elect Trump takes office,” Egan says. “Although manufacturers pay the tariffs, these extra costs often get passed along to shoppers in the form of higher prices.”

1 in 3 Americans Are Stockpiling Items Out of Fear of the Future

One-third (34%) of respondents say they are stockpiling items because they feel fearful or uncertain about the future.

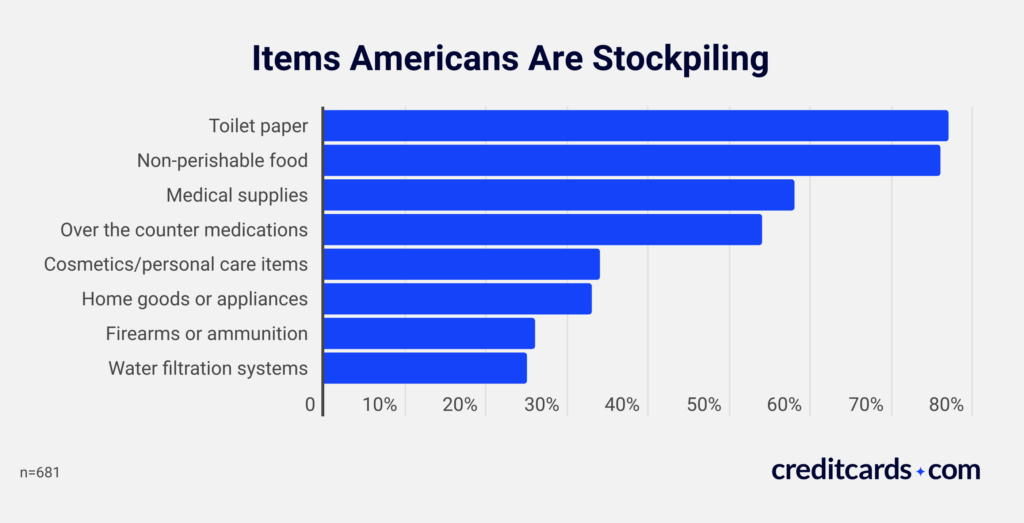

The most common items respondents say they are stockpiling are toilet paper (77%), non-perishable food (76%), medical supplies such as gloves and hand sanitizer (58%), and over-the-counter medications (54%). Respondents are also stockpiling cosmetics or personal care items (34%), home goods or appliances (33%), firearms or ammunition (26%), and water filtration systems (25%).

3 in 10 Plan To Go Into or Worsen Debt To Secure Purchases Now

Among respondents, 26% plan to use credit cards for most of their purchases in November and December, 32% intend to use them for some purchases, and 42% won’t rely on credit cards at all.

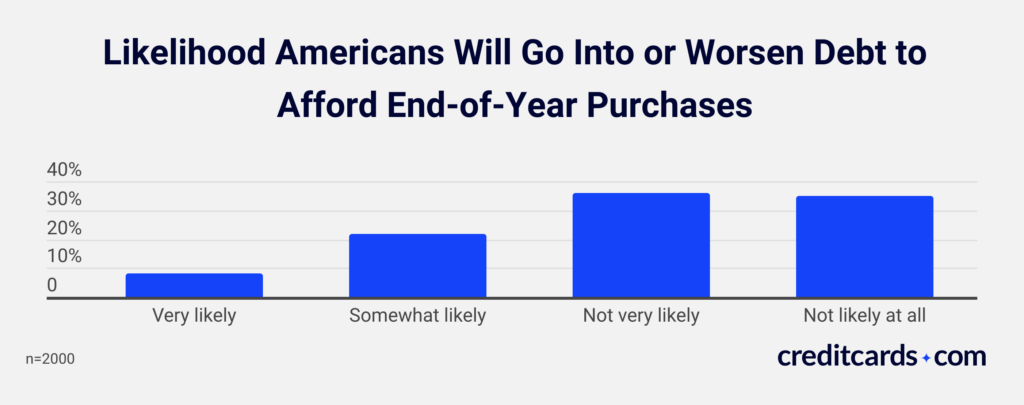

When asked about the likelihood of worsening or going into debt to secure their purchases, 8% say it is very likely, and 22% say it is somewhat likely. On the other hand, 36% report it is not very likely, and 35% say it is not likely at all.

“Generally, it’s not a good idea to go into debt to make purchases that you can’t afford right now. That’s especially true if you’re talking about high-interest credit card debt,” Egan says.“

But it might make sense to take a buy now, pay later approach if you’re able to nail down a zero-interest or low-interest offer, and you can pay off the debt quickly. It also can be acceptable to take on debt if the money would cover a necessity, such as replacing a must-have car that needs thousands of dollars in repairs or covering emergency medical expenses.”

Methodology

This survey was launched November 26, 2024 through the Pollfish platform. A total of 2,000 U.S. residents completed the full survey.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.