Summary

This February 2025 report by CreditCards.com examines consumer spending habits since President Donald Trump took office, focusing on the role economic factors and uncertainty play. Key findings: 1 in 5 Americans are buying more than usual, most driven by Trump’s tariffs 3 in 10 Americans are purchasing items in preparation…

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

This February 2025 report by CreditCards.com examines consumer spending habits since President Donald Trump took office, focusing on the role economic factors and uncertainty play.

Key findings:

- 1 in 5 Americans are buying more than usual, most driven by Trump’s tariffs

- 3 in 10 Americans are purchasing items in preparation for another pandemic

- 42% of Americans are or will start stockpiling items, mainly food and toilet paper

- 1 in 4 Americans have made large purchases since November in fear of Trump’s tariffs

- 1 in 5 Americans say they are “doom spending” — purchasing items excessively or impulsively in response to fears or anxiety about future events

- 23% of Americans expect to worsen or go into credit card debt this year

Fear of Trump’s Tariffs Is Fueling More Purchases Than Usual

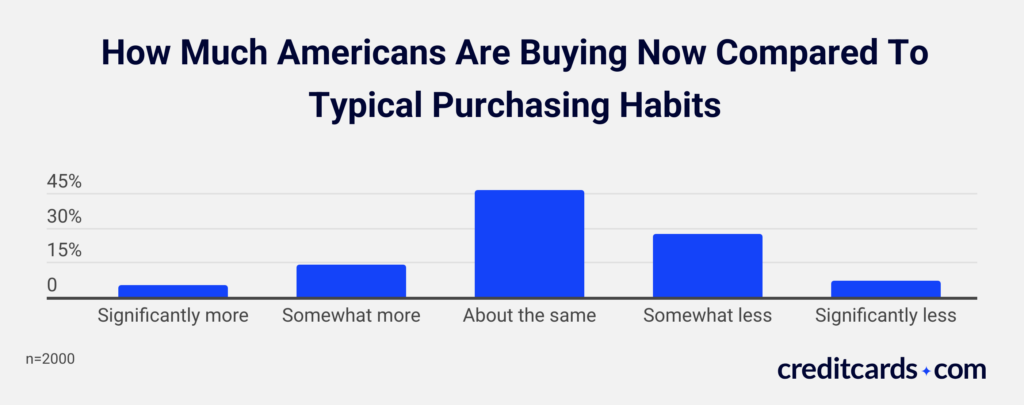

Nineteen percent of respondents say they are buying significantly more (5%) or slightly more (14%) items than usual. Of this group, 29% say fear of Trump’s tariffs greatly impacts their desire to make additional purchases, while 37% say it’s having some impact.

3 in 10 Americans have made large purchases since Trump was elected

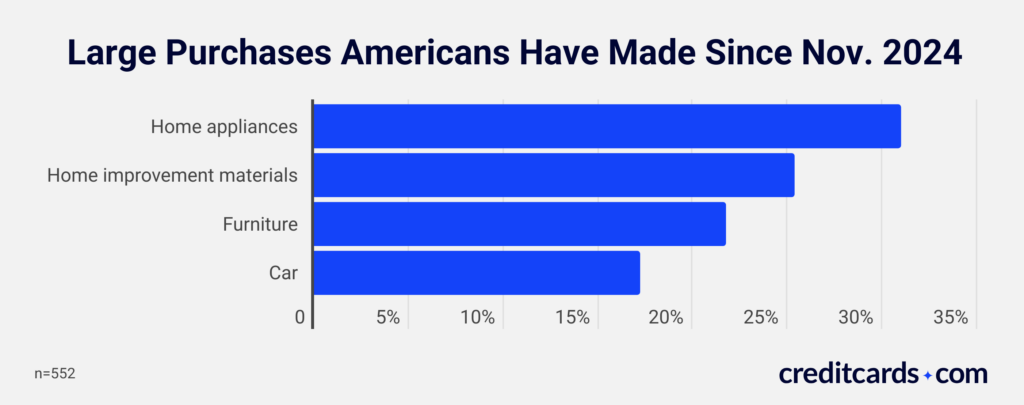

Since November 2024, 28% of Americans have made a large purchase over $500, while 21% have not but plan to soon.

Of those who made a large purchase, the most common items were electronics (39%), home appliances (31%), and home improvement materials (25%). Furniture (22%) and cars (17%) were also noted.

More than half (55%) of those who made large purchases took advantage of holiday deals, while 45% did not.

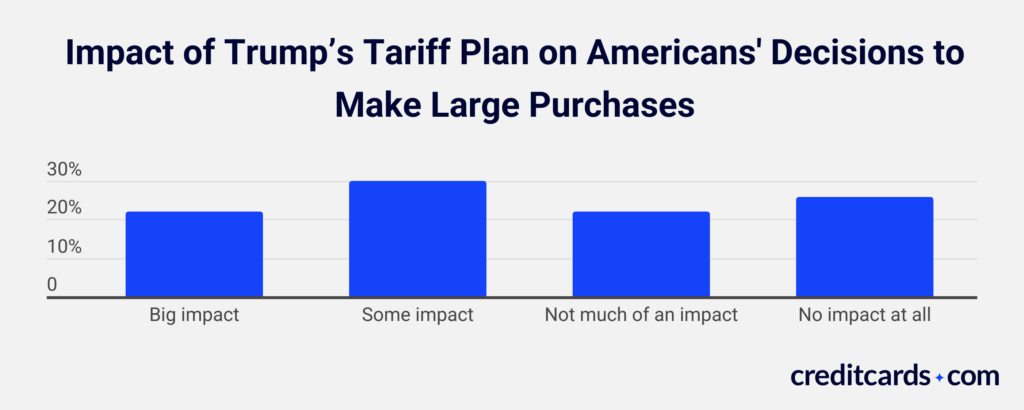

When asked about the impact of Trump’s planned tariffs on their large purchases, 22% say the tariffs had a big impact, 30% report some impact, 22% say there was not much impact, and 26% feel no impact.

“Researchers at S&P Global estimate the new tariffs could trigger a one-time increase of 0.5% to 0.7% in U.S. consumer prices, assuming the tariffs remain in effect through 2025,” says John Egan, credit cards, insurance and personal finance expert contributor for CreditCards.com. “But it’s too soon to say precisely how the new tariffs imposed by President Trump are affecting consumer spending. However, they very well could cause some consumers to rethink their buying habits, especially when it comes to major purchases.”

4 in 10 Americans Are Stockpiling Items

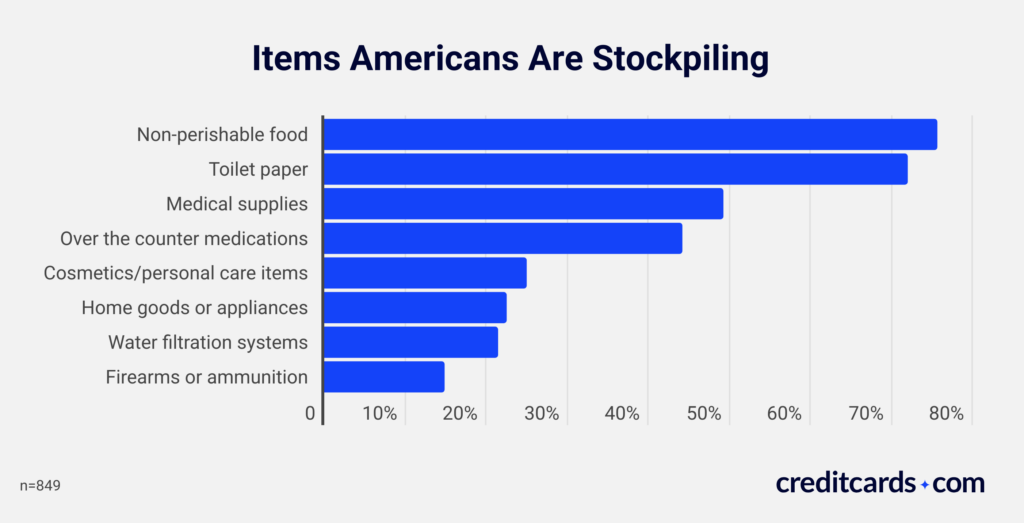

Since November 2024, more than two in 10 Americans (22%) say they are stockpiling items, while another 20% have not yet but plan to soon. About half (52%) say they have not and do not intend to stockpile, and 5% are unsure.

The most commonly stockpiled items include non-perishable food (76%) and toilet paper (72%). Nearly half (49%) stocked up on medical supplies, and 44% purchased over-the-counter medications. Smaller portions secured water filtration systems (21%), home goods or appliances (23%), personal care products (25%), or firearms and ammunition (15%).

3 in 10 Americans are preparing for a pandemic

When asked if they are purchasing items in preparation for another pandemic, 3% of Americans say they are buying many items, 11% are purchasing some, and 15% are buying a few. However, most (71%) say they are not making such purchases.

1 in 5 characterize their recent purchasing habits as doom spending

When asked if they would characterize their recent or planned spending habits as doom spending, 5% say they definitely are, while 13% say they are probably doing so.

“One of the drawbacks of doom spending is that it could prompt you to overspend and strain your budget,” says Egan. “In addition, doom spending might lead you to pile up credit card debt, which could put you in a financial hole due to interest charges and fees.”

1 in 4 Plan To Go Into or Worsen Debt To Secure Purchases Now

When asked about using credit cards to finance purchases, 28% of Americans say they rely on credit cards for most purchases, 37% use them for some, and 35% do not use credit cards for their purchases.

Looking ahead, of those who use credit cards, 34% say they are likely to worsen or go into credit card debt this year to secure purchases.

“Accumulating or adding to credit card debt is not a good idea at any time, unless you can fully pay off balances each month and avoid interest charges,” says Egan. “Your best bet is to use cash for big and small purchases whenever possible. Or you can look for 0% financing when making a big purchase, allowing you to avoid interest charges as long as you pay off the balance within a certain period of time.”

Methodology

This survey was launched on February 13, 2025, through the Pollfish platform. A total of 2,000 U.S. residents completed the full survey.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.