Summary

President Trump campaigned on implementing tariffs, a policy many believe will drive up prices. Since his election in November 2024, Trump has continued to push forward with his tariff agenda. Most recently, in April, he announced tariff plans that sent the stock market tumbling and reignited fears of a potential…

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

President Trump campaigned on implementing tariffs, a policy many believe will drive up prices. Since his election in November 2024, Trump has continued to push forward with his tariff agenda. Most recently, in April, he announced tariff plans that sent the stock market tumbling and reignited fears of a potential recession.

CreditCards.com surveyed 1,000 U.S. adults in April to understand how their spending habits have shifted since Trump’s election and how fears of rising prices influence their financial decisions. This report follows surveys we conducted in February and December.

Key findings:

- 1 in 5 Americans are doom spending

- 37% of Americans have stockpiled items since November 2024, and an additional 14% plan to start stockpiling soon

- 48% of Americans have made large purchases since November 2024

- Most Americans who’ve stockpiled or made large purchases cite fear of rising prices, though Trump voters were less likely to say so than Harris voters

- More than half of Americans will spend atypically in April 2025, suggesting uncertainty about the future

- 3 in 10 Americans expect to go into or worsen credit card debt this year

Nearly Half of Americans Have Been or Will Start Stockpiling Goods

Since November 2024, 37% of Americans say they’ve stockpiled items, and an additional 14% plan to soon. Stockpiling is more common among Kamala Harris voters (44%) than Trump voters (31%).

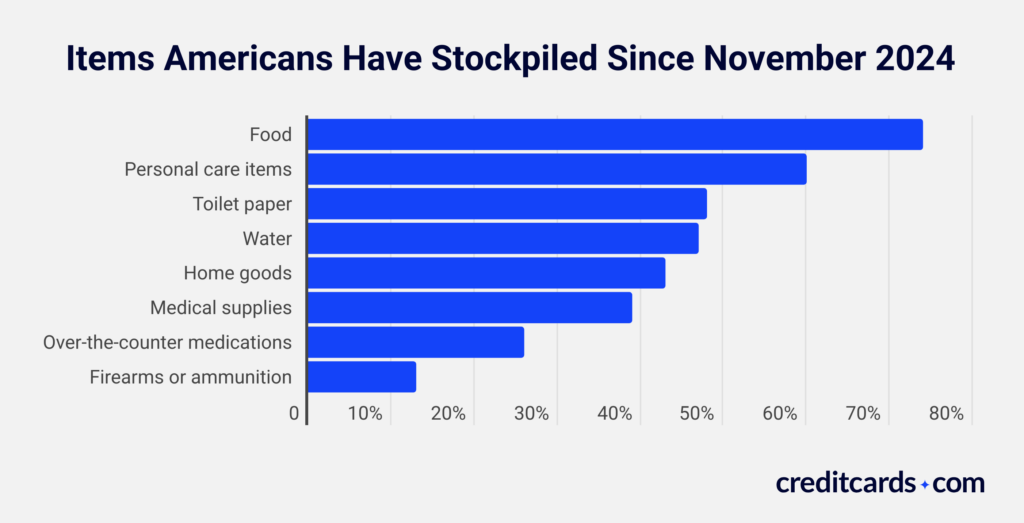

The most commonly stockpiled items include food (74%), personal care items (60%), toilet paper (48%), water (47%), and home goods (43%). Others have stockpiled medical supplies (39%), over-the-counter medications (26%), and firearms or ammunition (13%).

Among those who have stockpiled, 8 in 10 say fear of rising prices played a role — either a major role (51%) or a small role (28%). This concern is also more prevalent among Harris voters (82%) than Trump voters (72%).

“Fear of rising prices causes many people to stockpile all sorts of items, from toilet paper to electronics,” says John Egan, personal finance expert for CreditCards.com. “While it makes sense to stockpile certain items to avoid tariffs, only buy what you actually need and will actually use. Otherwise, you might wind up overspending.”

Nearly Half of Americans Have Made a Large Purchase Since November 2024

Nearly half (48%) of Americans have made a large purchase over $500 since November 2024, including 47% of Harris voters and 51% of Trump voters.

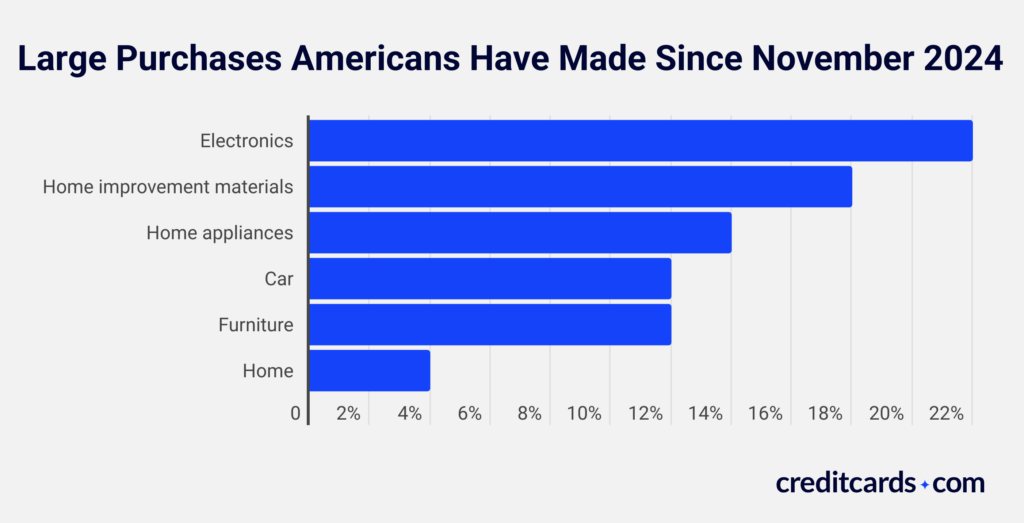

The most common purchases have been electronics (22%) and home improvement materials (18%). Others report buying home appliances (14%), cars (12%), furniture (12%), and homes (4%).

Fear of rising prices influenced many purchases — 36% say it played a major role, and 22% say it played a small role. This factor was more common among Harris voters (67%) than Trump voters (51%).

Spending Habits Shift in April, and Many Will Worsen Credit Card Debt

In April 2025, more than half of Americans plan to adjust their spending: 15% plan to spend significantly more (4%) or slightly more (11%), while 41% plan to spend slightly less (22%) or significantly less (19%). Meanwhile, 45% expect their spending to stay about the same.

Nearly three in 10 (28%) Americans say they are likely to go into or worsen their credit card debt this year, with 9% saying it’s very likely and 19% somewhat likely.

1 in 5 Americans are doom spending

Some Americans are also engaging in “doom spending” — spending money to cope with anxiety, fear, or pessimism about the future. About 5% of Americans definitely classify their recent spending as doom spending, 13% probably would, and 19% are unsure. This figure holds steady from what we found in our February 2025 report. Doom spending is nearly twice as common among Harris voters (26%) than Trump voters (14%).

“Economic uncertainty often causes people to cut back on spending. But amid the threat of tariffs on U.S. imports, some people might stockpile, make big purchases or engage in ‘doom spending,’” Egan says. “Unfortunately, these behaviors can lead to piling up credit card debt. Ideally, you should use cash for purchases in situations like this and set aside as much money in savings as you’re able to.”

Methodology

The Consumer Sentiment Post Trade War Poll was conducted by YouGov using a nationally representative sample of 1,000 U.S. adults interviewed online between April 11 and April 14, 2025. The adjusted margin of error for a sample percentage based on the entire sample is approximately 3.57%.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.