Summary

The 2024 Black Friday/Cyber Monday shopping season has ended, leaving more Americans in debt. CreditCards.com examined how this year’s sales affected Americans’ finances by surveying 1,000 U.S. adults who participated in Black Friday and/or Cyber Monday. Key findings include: Over one-third of shoppers spent more than they wanted to Two-thirds…

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

The 2024 Black Friday/Cyber Monday shopping season has ended, leaving more Americans in debt. CreditCards.com examined how this year’s sales affected Americans’ finances by surveying 1,000 U.S. adults who participated in Black Friday and/or Cyber Monday.

Key findings include:

- Over one-third of shoppers spent more than they wanted to

- Two-thirds bought more than they normally would; many cite “doom spending”

- 1 in 4 took on new or additional debt to fund their Black Friday shopping

- Half of those who went into credit card debt for Black Friday maxed out their cards

- 1 in 3 said holiday shopping worsened their financial stress

4 in 10 Shoppers Spent More Than They Intended To

When asked how they view the amount of money they spent on sales this year, 12% of respondents said they spent less than they intended to, 51% spent as much as they planned to, and 37% spent more than they budgeted for.

Among those who overspent, 87% said impulse buying somewhat (53%) or greatly (34%) affected their spending habits. Also, 46% said they experienced some (32%) or a lot (14%) of buyer’s remorse.

Doom spending drives additional purchasing

In addition to spending more money than they wanted to, 65% of shoppers said they purchased more items than they normally would. Of this group, two-thirds said “doom spending” (the fear of prices rising in the future) caused them to buy more this shopping season.

“With a presidential transition about to take place and a war raging in the Middle East, it wouldn’t be surprising if doom spending lingers for a while,” says John Egan, credit cards, insurance, and personal finance expert contributor at CreditCards.com.

“The looming threat of tariffs on consumer goods imported into the U.S. from China, Mexico, and other countries might also contribute to the continuation of the doom spending trend,” he continues.

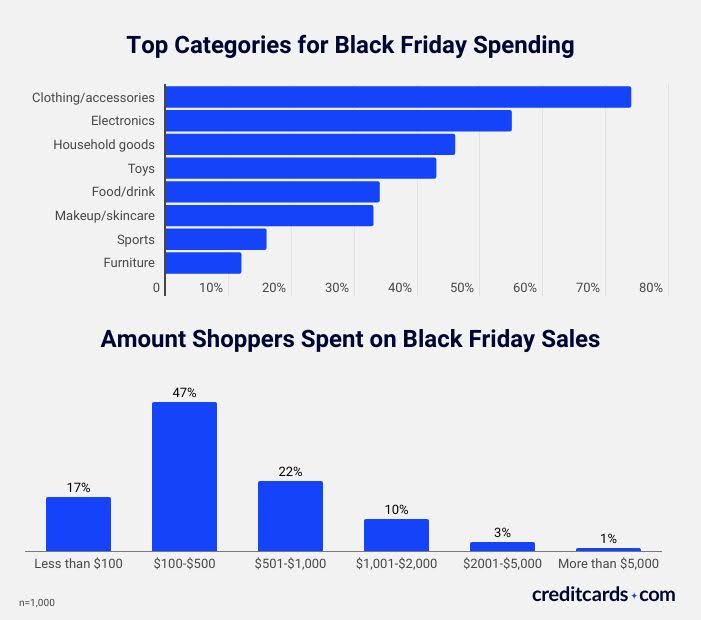

When asked to estimate how much money they spent on sales this year, 1 in 7 reported spending $1,000 or more, while the largest percentage (47%) spent between $100 and $500. The top shopping categories reported by respondents include clothing/accessories (74%), electronics (55%), household goods (46%), and toys (43%).

Americans Spent the Most on Their Kids; Many Opened New Credit Cards To Do So

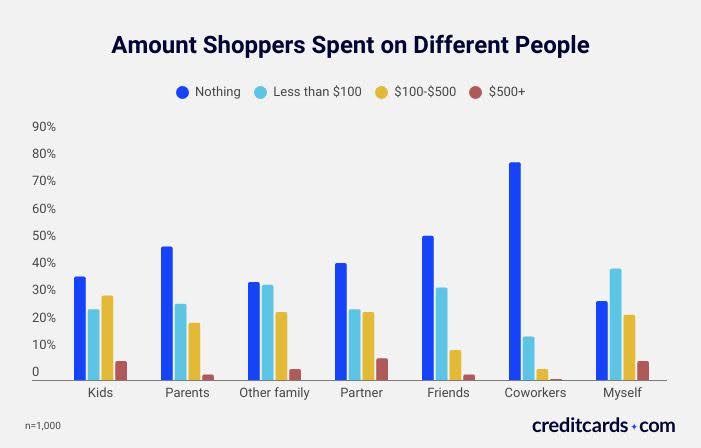

Black Friday shoppers report spending the most on gifts for their kids, followed by their partners and themselves.

Many opened new credit cards to do their Black Friday shopping. While 17% said they opened one new credit card, 7% got two or more new cards. Additionally, 20% opened one or more new store credit cards.

1 in 4 Went Into Debt To Fund Black Friday Purchases

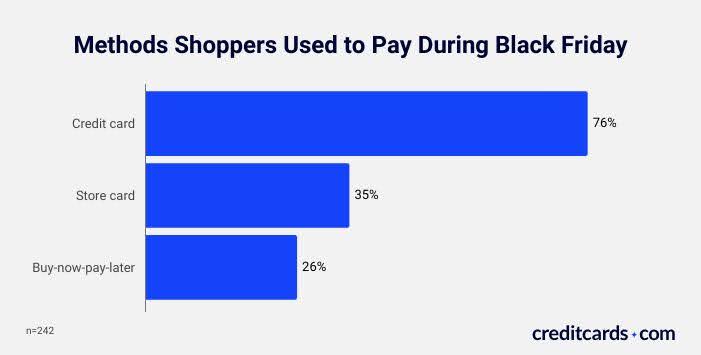

Of shoppers surveyed, 10% said they went into new debt because of their holiday shopping, while 14% said they worsened their existing debt. Three-quarters of those who went into debt reported using credit cards for their holiday purchases, 35% utilized store credit cards, and 26% used a buy-now-pay-later service.

Alarmingly, 45% of those who went into debt because of holiday shopping are somewhat (28%) or highly considering (17%) filing for bankruptcy due to overwhelming debt. However, only 17% also said they are somewhat (15%) or highly unlikely (2%) to fully recover before the 2025 holidays.

Half of Those Who Went Into Credit Card Debt Maxed Out Their Cards

Among shoppers who went into debt due to holiday shopping and used credit cards to do so, 55% said they maxed out one or more of their cards. Additionally, 37% said they are not very (24%) or not at all confident (13%) they’ll be able to pay off their next credit card bill in full. Within this group, 72% are somewhat (41%) or highly likely (31%) to make only the minimum payment on their next credit card bill.

Half of those who went into credit card debt are also somewhat (29%) or highly likely (23%) to open an additional credit card to pay off their current debt. Of those likely to open a new card, 55% said they will transfer their credit balance, and 68% plan to make additional holiday purchases.

“Getting another credit card to pay off current debt typically won’t help unless you obtain a balance transfer card that offers an introductory 0% interest rate for a certain period, such as 12 or 18 months,” advises Egan.

“Just be sure to pay off the full balance on the card before the 0% rate period ends. Otherwise, you’ll wind up paying interest. Also, avoid putting purchases on the card while you’re trying to wipe out the balance you’re paying off at the 0% rate,” Egan says.

Holiday Shopping Worsened Financial Stress for 1 in 3 Americans

A total of 31% of respondents said that holiday spending somewhat (26%) or greatly (5%) worsened their financial stress. Additionally, only 15% said they completed all their holiday shopping during the sales, while the majority completed only half or less.

“To limit financial stress during the holiday season, create and stick to a shopping list, set a budget for holiday spending, resist impulse purchases, and hunt for discounts on gifts,” says Egan. “You can also ease financial stress related to holiday shopping by restricting the number of purchases you make with credit cards, particularly those with high interest rates.”

Methodology

This survey was launched online on December 4, 2024, through the Pollfish platform. A total of 1,000 U.S. residents 18 and up completed the full survey. All respondents self-selected that they participated in Black Friday and/or Cyber Monday sales this year.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.