Summary

Estate planning is a critical step in securing financial stability for loved ones. Yet, nearly half of Americans don’t have any estate planning documents, such as a will or living trust. A new CreditCards.com survey of 1,500 American adults reveals why many people are putting it off and how factors…

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Estate planning is a critical step in securing financial stability for loved ones. Yet, nearly half of Americans don’t have any estate planning documents, such as a will or living trust. A new CreditCards.com survey of 1,500 American adults reveals why many people are putting it off and how factors like inflation, debt, and political concerns shape estate planning decisions.

Main takeaways:

- Belief of having insufficient assets is a top reason for not having an estate plan.

- 1 in 3 Americans in debt without an estate plan cite debt, particularly credit card debt, as a contributing factor.

- Inflation, Trump’s presidency, and public health concerns shape estate planning decisions.

Many Don’t Feel They Have Enough Assets to Warrant Estate Planning

According to Caring.com’s 2025 Wills and Estate Planning Survey, only 24% of Americans report having a will, marking a decline in estate planning.

Many Americans surveyed own valuable assets that could benefit from structured planning. The most commonly owned assets include: Bank accounts (85%), cars (77%), homes (61%), investment accounts (51%), and cryptocurrency (17%).

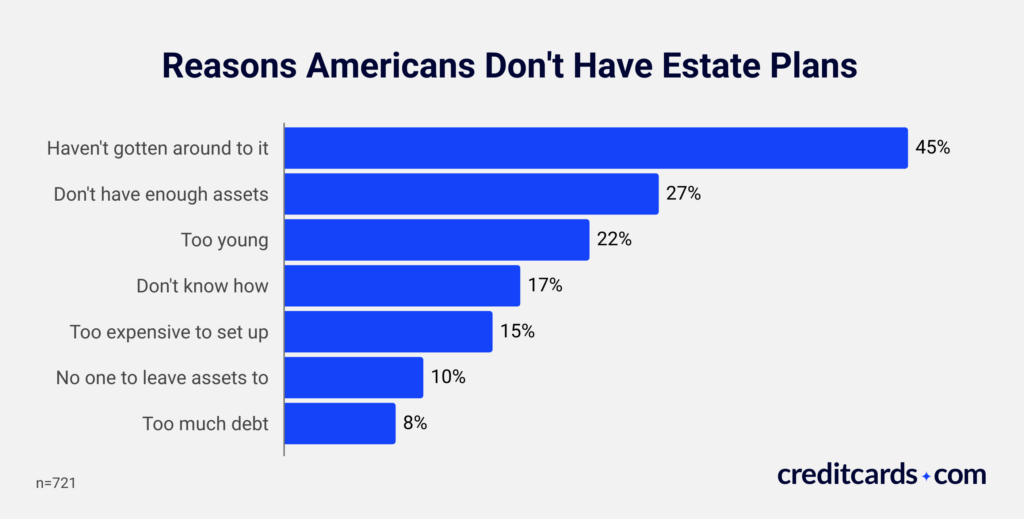

However, one of the most common reasons for not having a will or trust is not believing they have enough assets (27%).

The most common reason for forgoing estate planning is procrastination—45% say they simply haven’t gotten around to it. Other common reasons include feeling too young to need estate planning (22%), not knowing how to create a will or trust (17%), cost concerns (15%), and having too much debt (8%).

“Estate planning isn’t just for wealthy people. Any adult who owns assets or has dependents should create an estate plan,” says John Egan, a credit cards, insurance and personal finance expert contributor for CreditCards.com. “Without an estate plan, your wishes might not be carried out after you die.”

Credit card debt affects estate planning

Debt is another factor influencing estate planning decisions. Of the respondents surveyed, 38% have credit card debt, 22% have a mortgage, and 19% have car payments. Other common financial burdens include medical debt (15%) and student loans (12%).

For those with credit card debt, 22% owe between $2,001 and $5,000, 19% carry balances between $5,001 and $10,000, and another 22% owe more than $10,000.

Among those with debt who don’t have an estate plan, 21% acknowledged debt plays at least some role in their decision, and 10% said it is a definite barrier to estate planning.“

Debts typically are paid by your estate before beneficiaries receive any of your assets. Some debts might be forgiven, though, if the assets in your estate won’t cover them,” Egan says. “Regardless of how much debt you have, creating an estate plan is a wise move, as this kind of planning is designed to financially protect your loved ones.”

Inflation, Politics, and Public Health Impact Estate Planning Decisions

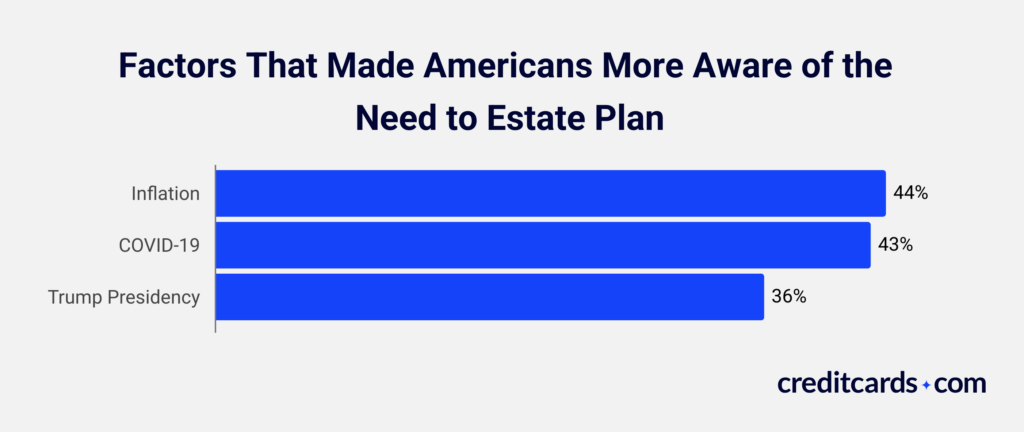

Inflation has made 44% of respondents more aware of the need for an estate plan, while 52% say their views on estate planning remain unchanged.

The Trump administration’s policies have also influenced estate planning decisions. More than a third (36%) say they now see more of a need for estate planning due to concerns about estate tax law changes (43%), future tax policy uncertainty (49%), and protecting assets for future generations (47%). Others cited inflation and economic instability (59%) and market volatility (51%) as reasons for prioritizing estate planning under Trump.

Public health crises have also influenced estate planning decisions. The COVID-19 pandemic made estate planning a greater priority for 43% of respondents, while 53% said it did not change their perspective.

These concerns are even more influential for younger generations. Among Gen Z, 57% say inflation has prioritized estate planning, 47% point to Trump policies, and 43% cite COVID-19. Millennials are similarly motivated, with 51% citing inflation, 46% Trump’s policies, and 51% the pandemic as factors in their decision-making.

“Among other things, changes in inflation, tax rates, the political landscape, and public health can have a big impact on estate planning. That’s because these types of events can affect the value of your assets, especially stocks, and the amount of money you have in the bank,” says Egan.”

Little Consensus On What Age Someone Should Start Estate Planning

While most Americans agree estate planning is important, there is little consensus on when to start. According to the survey, 11% believe a will should be in place as early as age 18, and 33% believe people should have a will by age 35, while 22% say it should happen by age 45. Another 19% believe age 55 is the right time, while 11% say estate planning should wait until age 65 or later.

Methodology

This survey was launched in January 2025 through the Pollfish platform. A total of 1,500 U.S. residents completed the full survey. The sample was balanced to reflect the age and gender distribution of the U.S. population.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.