Summary

Although 37% of Americans said their main source of financial advice comes from friends and family, Gen Zers cited social media as a go-to source. And 31% of those surveyed said they got no financial advice at all.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

How did you learn about personal finance? Was it through discussing budgeting tips with friends, consulting family members on the best credit cards, studying financial topics in school or maybe picking up recommended reading material?

According to a recent CreditCards.com survey, 37% of U.S. adults cited friends and family as their go-to resources for financial advice. But the survey also found that Gen Zers were nearly five times as likely (28%) as adults ages 41 and over to say they got financial counsel from social media.

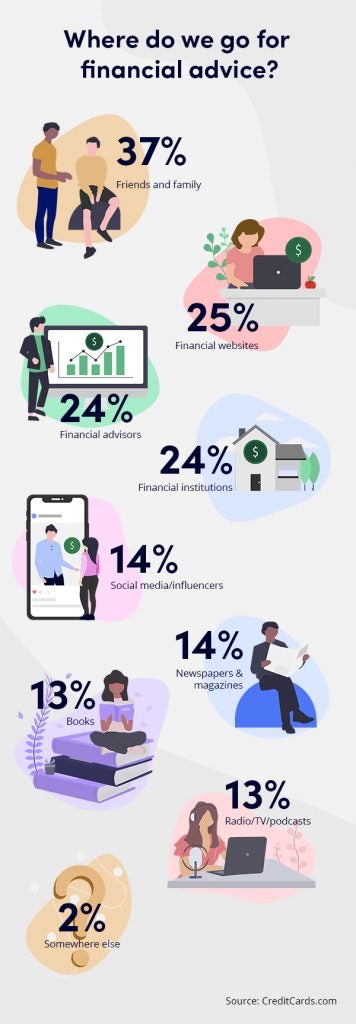

U.S. adults overall also sought financial advice from other sources: A quarter (25%) turned to financial websites. Nearly a quarter (24%) went to financial advisors, and the same percentage took advice from financial institutions. Significantly fewer turned to social media platforms or influencers (14%); newspapers or magazines (14%); books (13%); radio, TV or podcasts (13%); or somewhere else (2%).

And almost one-third (31%) said they get no financial advice at all.

Respondents’ answers to the question, “Who taught you the most about how to manage money?” were overwhelmingly “myself” (43%), followed by “my mom” or “my dad” (19% and 17%, respectively).

It’s important to remember that financial matters are personal and that everyone’s circumstances are a bit different, said Ted Rossman, senior industry analyst at CreditCards.com.

And Rossman said that’s why it’s important to blend a variety of outside perspectives with your own experiences and goals.

“I don’t think any of these mediums have inherently good or bad financial advice – it’s more about what you do with it,” Rossman said.

See related: Where to get free financial advice

Financial literacy poll: key findings

Here are some other major findings from our financial literacy poll:

- Financial websites are important: Many respondents said they get

financial advice from financial websites, including 25% of Gen Zers, 30% of millennials, 27% of Gen Xers and 19% of baby boomers. - Age makes a difference: The poll showed that of those who get advice from friends and family, Gen Zers lead the way at 53%, while millennials come in at 44%, Gen Xers at 37% and boomers at 25%.

- Gen Zers favored social media the most: Twenty-eight percent of Gen Zers said they sought advice from social media platforms and influencers, while only 24% of millennials, 10% of Gen Xers and 4% of boomers said the same.

- More Gen Zers go without advice: Twenty-two percent of Gen Zers admitted to getting no financial advice at all, compared with 23% of millennials, 36% of Gen Xers and 39% of boomers.

- The most trustworthy sources: Seventy percent of survey takers said they felt financial advisors are trustworthy (versus 16% who said they are not), 69% found financial institutions trustworthy (versus 20% not trustworthy), 64% found friends and family trustworthy (versus 24% not trustworthy), 60% found books trustworthy (versus 22% not trustworthy) and 57% found financial websites trustworthy (versus 26% not trustworthy).

- The least trustworthy source: Only 21% of respondents said that social media platforms are trustworthy (versus 65% who said they are not).

- All income levels listed friends and family as trusted advisors first: Most households earning $80,000-plus annually said they got financial advice from family and friends (45%) and financial advisors (39%). And 32% of those families making less than $40,000 per year said they got advice from family and friends, while 12% said financial advisors. Nearly half the respondents in the lowest income bracket (42%) said they don’t get any financial advice at all, compared with middle-income earners (30%) and highest-income earners (14%).

The survey of 2,603 U.S. adults was conducted online between March 10-12, 2021. See survey methodology.

See related: How to create a budget that works for you

America’s financial literacy is low to no

These survey results illustrate the poor state of financial literacy in America, Rossman said.

With little formal personal finance education, most people are forced to go it alone. But your financial decisions have a major impact on your quality of life. Rossman questioned how safe it is to entrust that responsibility to your family and friends.

“They may be good people, but there’s a good chance they don’t know much about managing money,” Rossman said.

Rossman said that although there’s a lot of room for improvement when it comes to Americans’ financial literacy, he’s encouraged that so many of us are having these conversations.

Money can be a taboo topic, so it’s a step in the right direction that a lot of people are discussing it with family and friends and seeking out information on their own.

The school of hard knocks is a tough teacher, Rossman warned, and it’s better to educate yourself before you run into financial difficulty.

You don’t necessarily need a financial advisor, but if you didn’t learn much about money in school or at home, you need to take it upon yourself to further your financial education, he recommended.

That could involve reading a book, magazine or website, listening to a podcast or radio program, watching a TV show or discussing money with people you trust.

“I am pleased that social media rated as the least trustworthy source of financial advice because there are a lot of kooky financial tips on there,” Rossman said.

And he was surprised traditional media outlets didn’t garner more trust.

Rossman advised that moderation is probably best: Check out a variety of sources and decide what fits best for you and your situation.

There’s a dire need for financial education – but not from social media

Rupeng Liao, a senior analyst at comScore who works with the company’s financial services clients on digital strategy consulting, was shocked that 1 in 3 respondents said they don’t receive any financial advice at all. It signals a desperate need for more financial education in America, he said.

And he understands why some turn to social media for advice but doesn’t think it’s the best way to go, at least not right now.

If we look through existing education-related resources, Liao said, many of them continue to be text-heavy and not easily digestible, which could be why 28% of GenZers trust social media influencers: “finance TikToks” are more digestible and easily understood.

Creators simplify complex concepts down to the basics, and most of them do a good job at explaining them within a minute, Liao said. These videos fill the gap left by the lack of easily digestible learning materials.

But Liao has his doubts regarding whether some of the creators are trustworthy.

Unlike professional publications, social media content creators tend not to disclose their financial positions or experience, which in Liao’s opinion is troublesome.

The good news, Liao said, is that trust is high for banking services, as shown by our survey. This gives financial institutions the leverage to provide educational content to their customers and perhaps use their own social media influencers to create viral educational content.

See related: Teaching financial literacy to children and teens

Lower-income households need more help

Brian Deschere, founder of Breaking Into Wall Street, noted that the results showed higher income brackets head to financial advisors more often than low-income earners, who said they rarely get a professional’s opinion on finances.

As higher-income investors likely benefit from more professional investment advice, this problem will compound, making their larger pile of money exponentially larger, Deschere said.

The best way to help everyone benefit is to offer low-income earners worthwhile investment tools with smaller entry barriers.

“We are already seeing this with investing apps, and I think we’ll likely watch that piece of the market continue to grow,” Deschere said.

Bottom line

Because financial matters are so personal, it’s essential that you educate yourself in a way that’s best for your needs. Whether that’s by reading books, listening to podcasts, visiting websites, speaking with your financial institution or seeking a financial advisor, the most important thing is that you find a source that “speaks” to your particular circumstances.

Survey methodology

CreditCards.com commissioned YouGov Plc to conduct the survey. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 2,603 adults. Fieldwork was undertaken March 10-12, 2021. The survey was carried out online and meets rigorous quality standards. It employed a non-probability-based sample using both quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.