Summary

Generation Z (Gen Zers) have been increasingly engaging in “doom spending,” the practice of self-soothing through shopping. This October report by CreditCards.com examines the financial habits of full-time Gen Z workers who hold credit cards. Overall, 1,261 full-time Gen Z workers were surveyed, and a…

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Generation Z (Gen Zers) have been increasingly engaging in “doom spending,” the practice of self-soothing through shopping.

This October report by CreditCards.com examines the financial habits of full-time Gen Z workers who hold credit cards. Overall, 1,261 full-time Gen Z workers were surveyed, and a total of 800 (63%) of them who hold credit cards participated in the full survey.

The findings shed light on the significant challenges young people are facing in managing spending and making timely payments, underscoring the need for better financial education and budgeting practices.

Main takeaways:

- 63% of Gen Zers have credit cards

- 33% of Gen Zers carry credit card debt

- Mismanaging their budget is a top reason Gen Zers missed credit card payments

- A number of Gen Zers have their parents help them make payments

- 1 in 5 don’t know their credit score

1 in 3 Gen Zers Have Credit Card Debt

Among Gen Zers who hold credit cards, a majority—70%—limit their use to one or two. Another 25% have three or four credit cards, while just over 5% have five or more cards in their possession.

Over half (56%) of Gen Zers with credit cards have missed or made a late payment, while 44% report consistently paying on time. Moreover, 52% of Gen Z credit card holders (or 33% of the total sample) say they are carrying credit card debt.

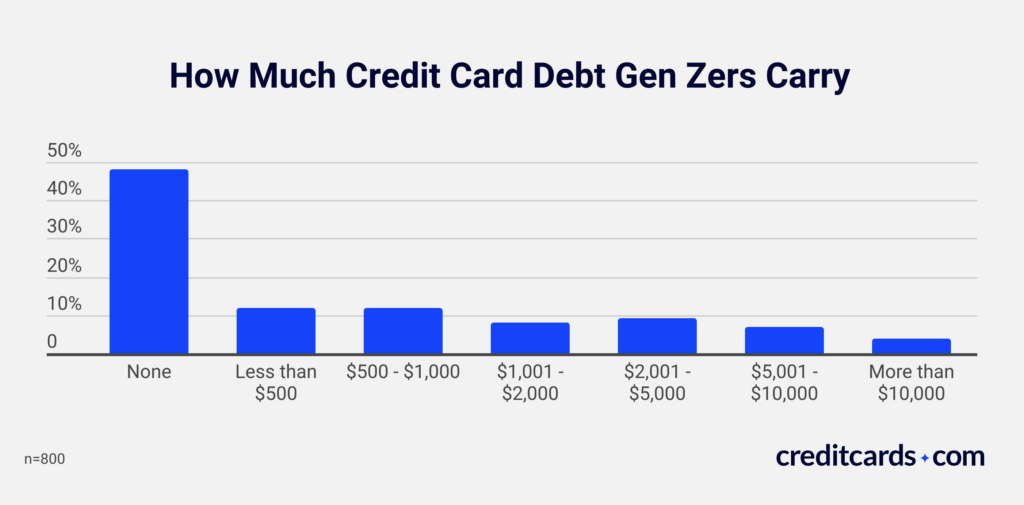

Debt levels vary widely among Gen Zers. Of those with debt, 12% owe less than $500, 12% have debt between $500 and $1,000, and 8% owe between $1,001 and $2,000. A number of Gen Zers also carry larger debts, with 9% owing between $2,001 and $5,000, 7% between $5,001 and $10,000, and 4% reporting credit card debt over $10,000.

“For Gen Z, it’s quite interesting to see that nearly two-thirds are already using credit cards,” says David Chen, director of finance at Srlon who has observed evolving credit card trends among generations as a finance expert with 18 years of experience. “This can be a powerful tool for building credit history, but it comes with certain responsibilities.”

“I recommend getting a credit card as soon as one starts earning independently, but it’s crucial to understand how credit functions. For instance, maintaining low balances and timely payments significantly affect credit scores. Many young people, unfortunately, don’t have a complete grasp of these factors, which leads them into debt.”

1 in 4 max out credit cards most months

Among Gen Zers currently carrying credit card debt, 9% have maxed out a card every month in the past year, while 17% did so most months, and 30% maxed out their cards during some months. Another 29% report rarely reaching their credit limit, and 16% have never maxed out a card.

Gen Zers also use their parents’ credit cards with some frequency. While 74% say they never use their parents’ cards, and 16% admit to using them rarely, 7% sometimes do, 3% do so frequently, and about 1% always use their parents’ credit cards.

A mismanaged budget is a key factor in credit card debt

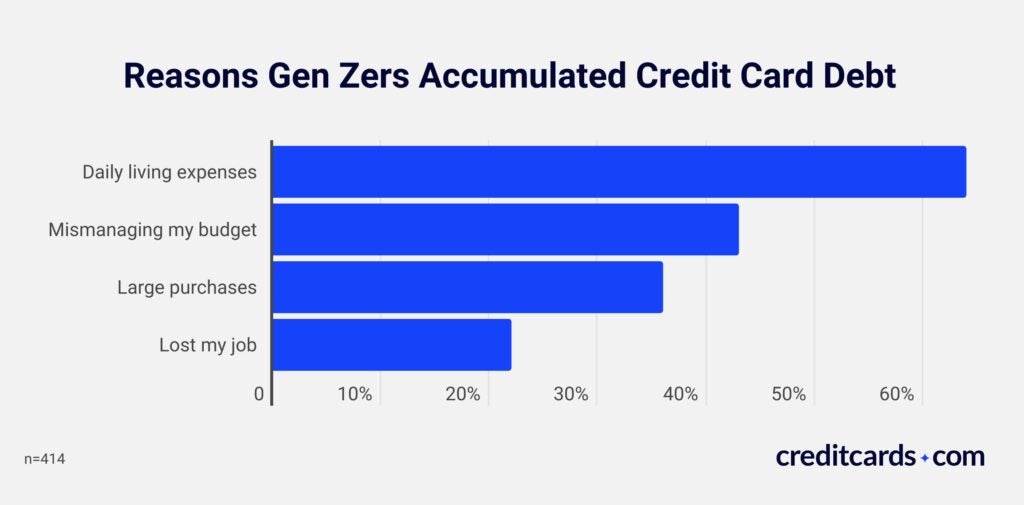

Nearly two-thirds (64%) of Gen Zers with credit card debt attribute it to covering daily living expenses. Additionally, 44% point to mismanaging their budget as a key factor behind their debt, while 36% blame large purchases for pushing them into debt. Job loss has also played a role, with 22% citing it as a significant contributor to their credit card balances.

Despite these habits, the majority of Gen Zers in debt remain optimistic about their ability to pay off what they owe. Nearly half (46%) are very confident they will pay off their credit card debt, and 39% are somewhat confident. However, 9% rely on their parents to help cover these debts.

“Most young adults think of their credit cards as free money and incur debts unnecessarily,” says Adam Garcia, founder of The Stock Dork. “It is very important to remember that every payment will have consequences for the future. In my practice, I focus on the attitude towards credit in the same way we relate to a budget or expenses.”

“Secured credit cards are an ideal choice for young adults. These types of credit cards demand a cash deposit to ensure that the customer does not default. This being the case, one is able to strengthen their credit profile without the risk of incurring debts.”

1 in 5 Credit Card Holders Don’t Know Their Credit Score

When it comes to financial literacy, there are notable gaps among Gen Zers with credit cards. While 24% consider themselves very financially literate, the majority (60%) describe themselves as somewhat financially literate, 16% say they are not very financially literate, and 1% admit to no financial literacy at all.

Further illustrating these gaps, 19% of Gen Zers do not know their credit score, and 5% are unaware of how their credit score impacts their ability to make major purchases such as buying a car or a home.

Additionally, a significant portion of Gen Zers have not yet embraced tools that could help them manage their finances more effectively. Forty-one percent have never used a financial planning tool or budgeting app, highlighting an opportunity for better financial education and resource utilization.

However, there is broad support for improving financial education, with 69% of Gen Zers believing that financial literacy courses should be mandatory in both high school and college. Seventeen percent think such courses must be obligatory only in high school, 8% say only in college, and 6% do not think financial literacy courses should be mandatory at all.

3 in 10 Gen Zers With Credit Cards Have $100 or Less in Savings

Nearly half (46%) of Gen Zers with credit cards have yet to begin contributing to a retirement account, indicating a potential gap in long-term financial planning.

In terms of savings — excluding retirement accounts — the financial picture varies widely among Gen Zers with credit cards. While 19% report having no savings at all, 10% have only $1 to $100 set aside. Also, 13% have saved between $101 and $1,000, and 18% have accumulated between $1,001 and $5,000. For those with larger amounts of savings, 12% have between $5,001 and $10,000, 10% hold between $10,001 and $20,000, and 19% have more than $20,000 in savings.

Methodology

This survey was launched in September 2024 through the Pollfish platform. Qualified respondents were selected based on a screening question and demographic criteria. A total of 800 full-time Gen Z workers (ages 18 to 27) completed the full survey, while 461 respondents were disqualified at a screener question for not indicating that they currently have a credit card.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.