Summary

CreditCards.com surveyed 1,500 U.S. residents who held at least one credit card in October 2024 to learn more about how holiday spending will impact Americans’ financial health. Main takeaways: Half of the respondents currently carry credit card debt 96% of respondents with credit card debt will still make holiday purchases…

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

CreditCards.com surveyed 1,500 U.S. residents who held at least one credit card in October 2024 to learn more about how holiday spending will impact Americans’ financial health.

Main takeaways:

- Half of the respondents currently carry credit card debt

- 96% of respondents with credit card debt will still make holiday purchases

- 1 in 3 debt holders expect to go further into debt due to this year’s holiday purchase

- 1 in 6 respondents will open a new credit card to pay for holiday purchases, and 1 in 5 will take out store credit cards

- 25% of debt holders say holiday spending in 2023 is at least in part to blame

Half of Credit Card Holders Have Debt, Yet Most Will Make Holiday-Related Purchases

More than half (53%) of the credit card holders surveyed have debt, with 22% carrying balances of $5,000 or more.

Holiday expenses are a notable debt contributor, as one-quarter of those in debt report that some of their balances stem from holiday spending in 2023. Despite these existing balances, 96% of respondents in debt say they are still planning to make purchases for the upcoming holiday season.

“Before someone makes a single holiday purchase, they should consider how much debt they’re carrying and how much interest they’re being charged on their credit cards. This can help avoid finding a financial lump of coal in your stocking,” says Insurance and Personal Finance Expert Contributor John Egan.

Egan suggests creating a holiday spending budget you can stick to and paying with cash if possible. “If you truly want to avoid the post-holiday financial blues, determine whether you can give valuable gifts that cost little to no money,” he says. “For instance, you might make a batch of your Aunt Helen’s favorite cookies or frame a collection of your dad’s favorite photos.”

3 in 10 plan to go into further debt due to this year’s holiday spending

This year’s holiday season is set to deepen debt for many credit card holders, with three in 10 (30%) of those already in debt planning to increase their balances further. Even among those currently debt-free, 8% anticipate going into debt by the end of the holidays.

Overall, 48% of the credit card holders surveyed plan to max out at least one card by the end of the holiday season. For those already carrying balances, more than half (55%) expect to max out at least one credit card by the season’s end. Specifically:

- 27% will max out one card

- 15% plan to max out two cards

- 4% expect to max out three or more cards

Parents with existing debt are particularly vulnerable to this trend, with 54% indicating they’ll max out at least one card and 38% planning to go further into debt due to holiday spending.

“Maxing out a credit card can put you in a financial bind, perhaps relying on other credit cards to make purchases. It can also raise your credit utilization ratio, which is a key component of your credit score,” says Egan. “Another disadvantage of maxing out a credit card is that it’ll likely cause your monthly payments to go up.”

3 in 10 Americans Carrying Credit Card Debt Will Spend Thousands This Holiday Season

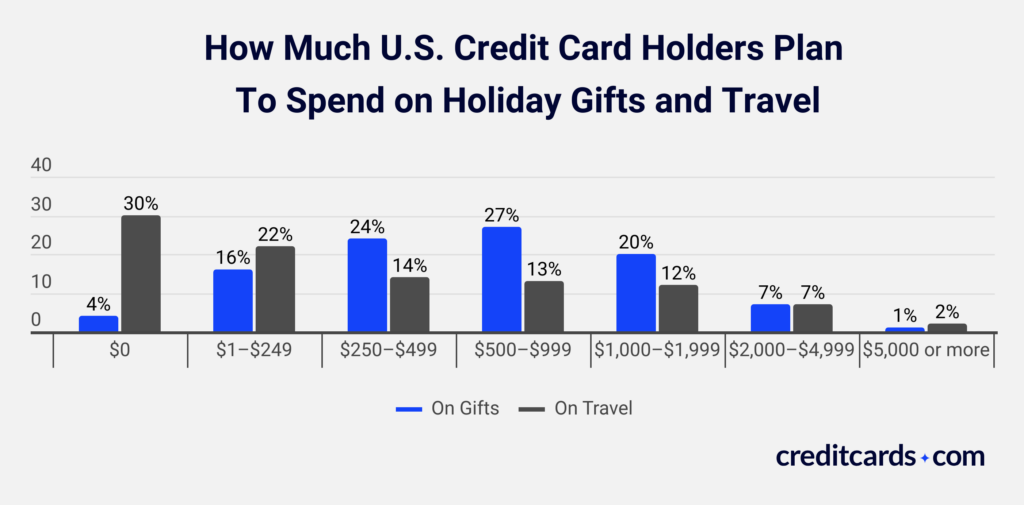

Americans with credit card debt are gearing up for significant holiday spending, often surpassing the planned expenses of debt-free consumers. Among those carrying credit card balances, most expect to spend on gifts, with around 28% anticipating holiday gift expenditures between $500 and $999. A further 21% plan to spend between $1,000 and $1,999, while 8% will spend between $2,000 and $4,999. Although a smaller share — only 1% — plans to spend $5,000 or more, just 4% don’t expect to spend on gifts.

Holiday travel expenses present another financial factor, with 22% of indebted Americans planning to spend between $1 and $249 on travel, while 16% anticipate spending between $250 and $499, and 14% between $500 and $999. Higher amounts are also common, as 11% expect to spend between $1,000 and $1,999 and 6% between $2,000 and $4,999. Only a small portion, 2%, will spend $5,000 or more on travel, while 28% don’t plan on any holiday travel spending.

The purpose of these holiday travel plans varies, with 51% traveling to see family, 38% combining family visits with vacation, and 11% solely vacationing. This range of expenditures and travel purposes underscores the financial commitments many Americans are making this holiday season, especially those already managing credit card debt.

1 in 6 Americans Will Open a New Credit Card To Pay for the Holidays

This holiday season, 16% of Americans plan to open a new credit card, with the primary motivation being promotional rewards or cashback opportunities, cited by 65% of those opening new accounts. Additionally, 56% are opening new cards to extend their available credit and help cover holiday expenses, while 21% are using this opportunity to consolidate existing debt.

1 in 5 will take out store credit cards

This holiday season, 1 in 5 Americans plan to take out a store credit card. Of those, 48% anticipate opening one store credit card, 42% expect to take out two, and 11% plan to open three or more. This reliance on store credit cards highlights the lengths some consumers are willing to go to cover seasonal expenses.

“There’s no magic number of credit cards that you should have. But you should limit the number of cards so that you don’t go overboard with spending,” says Egan. “Store credit cards are especially tricky, since they often charge higher interest rates than general credit cards do.” Also keep in mind that credit inquiries from applying for new credit cards typically cause a small, temporary drop in your credit score and will stay on your credit report for two years.

Methodology

This survey was launched in October 2024 through the Pollfish platform. Qualified respondents were selected based on a screening question and demographic criteria. A total of 1,500 U.S. adults who hold credit cards were surveyed.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.