Summary

During COVID-19, a study finds that credit card applications declined—a year later, and the trend continues.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

The number of Americans applying for credit cards tanked hard when the pandemic hit, just as it did with mortgages and auto loans. But the path to recovery looked much different for card applications — and moved slower — than for other credit types.

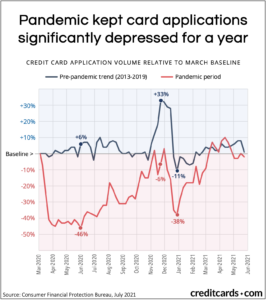

A 15-month study by the Consumer Financial Protection Bureau (CFPB) compared credit card application numbers according to a baseline established in March 2020, and also mapped volumes against the month-to-month trend seen in the pre-pandemic years of 2013–2019.

What the study found was that credit cards’ plunge at the start of the pandemic was so pronounced, and the depressed volumes so persistent, that it took a full year for the number of card applications to return to pre-pandemic levels, finally reaching normalcy in mid-March 2021. While applications recovered in the spring, they were back below baseline levels in May and June.

At their low point, in June 2020, COVID-era card applications were down a substantial 46% from pre-pandemic trends, while previous years’ volumes were up an average of 6% at that point in the calendar year.

Even the holiday spike that card applications typically see in November and December couldn’t bring pandemic card applications back to normal levels. In the study’s pre-COVID years, card applications spiked an average of 33% in late November. In contrast, November 2020 saw card application volumes depressed by 6%.

The post-holiday drop-off was notable as well, with COVID-era card applications crashing by 38% from March 2020 levels, compared to the more modest 11% drop seen before the pandemic.

Auto loans also took time to recover, though they climbed much faster than card applications and reached pre-coronavirus levels by January, after 10 months. Mortgage applications, on the other hand, not only recovered after less than two months but surpassed and have stayed above pre-pandemic levels ever since, due largely to historically low interest rates triggered by the Federal Reserve’s pandemic response.

The CFPB study drew from a longitudinal 1-in-48 sample of de-identified credit records from one of the three nationwide consumer reporting agencies, comprising some five million credit records. Its findings were published July 27.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.